Some Recovery

Depression or hyperinflation then Depression are the two choices staring at economic policy makers. And the situation is so far gone that short of dramatically cutting government spending there is no way to avoid destruction of the currency.

No economic policy that I know of can bring us back from this fate.

From Monty Pelerin’s World

Michael Panzer at Financial Armageddon has been rock solid in his claims that there is no “recovery.” Perhaps I admire this position so much because it is consistent with my own, a form of confirmation bias no doubt.

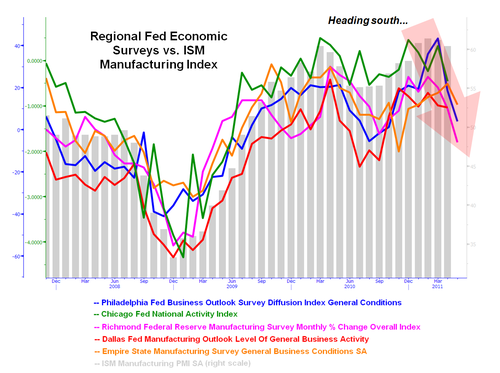

Below Mr. Panzer charts recent regional Federal Reserve surveys that are consistent with a downturn not an upturn. I would use the term “double-dip” except that implies we actually got out of the recession that began three years ago. We did not; we merely papered over it with unsustainable government spending and money creation.

Two things bother me about the data shown in the chart below:

- Are things so bad that regional Fed banks are no longer willing/able to cover it up (if in fact they ever were)?

- Or, is this stage-setting for the announcement that we must continue Quantitative Easing?

Point number two is the likely and more relevant of the two, although they are hardly mutually exclusive. To stop QE for any length of time would bring out the “Depression” term and expose the Federal Government as unable to pay its bills without the Fed purchasing their debt. We are nearing the end of our rope in either case. Depression or hyperinflation then Depression are the two choices staring at economic policy makers. And the situation is so far gone that short of dramatically cutting government spending there is no way to avoid destruction of the currency.

No economic policy that I know of can bring us back from this fate.

Although I’ve repeatedly questioned the notion that we’ve had a “recovery” in any genuine sense of the word, it looks like whatever we did have as a result of all the financial steroids that were injected into the U.S. economy since the financial crisis began is withering fast.

To wit, along with today’s “unexpectedly” bad data from the Richmond Federal Reserve (ably discussed here by The Market Ticker), we’ve also had similarly downbeat reports from their New York, Philadelphia, and Chicago counterparts (the Dallas survey is due out next week). In fact, three of the regional Fed indexes are at or near one-year lows.

Given how well one popular measure of economic activity, the ISM manufacturing index, has tracked these data series over time, odds are that the “R” word more and more people will be focusing on next won’t be “recovery” — it’ll be “recession.”

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: