One Reason Obama Wants Another State Bailout

A new study from two Harvard economists suggests that the president’s affinity for these subsidies might have something to do with the fact that the aid would be particularly helpful to states with more left-leaning legislators and strong public sector unions.

by Tad DeHaven at CATO @ LIBERTY

I recently discussed why the additional federal subsidies for state and local government that President Obama is proposing as part of his “job plan” are a bad idea. A new study from two Harvard economists suggests that the president’s affinity for these subsidies might have something to do with the fact that the aid would be particularly helpful to states with more left-leaning legislators and strong public sector unions.

The study from Daniel J. Nadler and Sounman Hong (see here) found that states with stronger public sector unions and a higher proportion of left-leaning state legislators face higher borrowing costs:

We find that, all things being equal, states with weaker unions, weaker collective bargaining rights, and fewer left-leaning state legislators pay less in borrowing costs at similar levels of debt and similar levels of unexpected budget deficits than do states with stronger unions and more left-leaning legislators. More practically, these findings suggest that the strength of public sector unions has become among the most important factors in bond market perceptions of a state’s risk of financial collapse.

Why do these states face higher borrowing costs? Nadler and Hong explain:

These “political” factors might signify to the bond market whether a state government has the willingness and capacity to initiate needed fiscal adjustments and austerity measures during the state fiscal crises that followed the financial crisis, and thus might provide some information to market participants about the likeliness that a given state government will choose to default on its debt instead of making politically difficult or undesirable budget cuts. Similarly, public sector labor environment variables, such as union strength, might signify to market participants the degree of organized political opposition state lawmakers would have to overcome to implement such austerity measures.

In a corresponding Wall Street Journal op-ed, Nadler and Paul E. Peterson, director of Harvard’s Program on Education Policy and Governance, do a nice job of explaining why the separation of responsibility between the federal government and the states has been crucial to the country’s economic rise:

Federal rescue of states is a dramatic departure from past practice. State bankruptcies date back to the 1840s when, amid a financial crisis, Pennsylvania, Michigan, Illinois and five other states discovered they had invested too heavily in infrastructure. The last state bankruptcy was in Arkansas during the 1930s. But overall the instances were few; in each case the federal government refused to come up with a fix.

Bankrupt states paid the price, but for the country as a whole, a system of fiscally sovereign states has proven incredibly beneficial to the nation’s economic well-being. Every state is responsible for its own police, fire, schools, transport and much more, and most of the time they do reasonably well. If they manage their affairs so as to attract business, commerce and talented workers, states prosper. If states make a mess of things, citizens and businesses vote with their feet, marching off to a part of the country that works better.

It is this exceptional federalist system that helped drive the rapid growth of the American economy throughout the first two centuries of the country’s history. Because state and local governments competed with one another for venture capital, entrepreneurial talent and skilled workers, governments generally had to be attentive to the needs of both citizens and commerce.

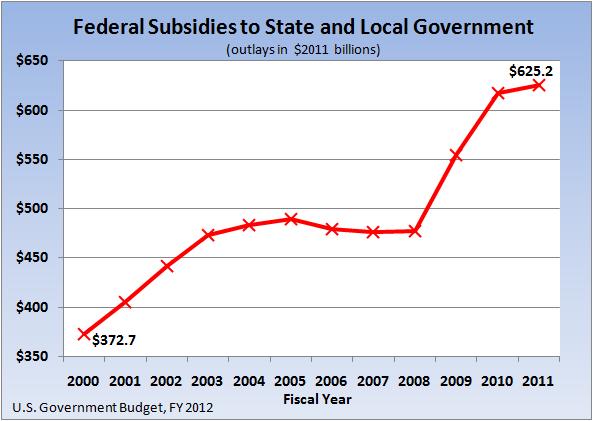

Unfortunately, the 20th century’s trend for the federal government to subsidize and manage more and more state and local affairs has worsened in the last 10 years as the chart in my blog post shows. If our bloated federal government is ever to be reined in, a return to fiscal federalism is a must. And if the states are to get their financial houses in order, state policymakers can’t be allowed to believe that a federal policy of “too big to fail” applies to them. (See this Cato essay for more on fiscal federalism.)

From a previous post by Tad DeHaven:

No Additional Subsidies for State & Local Governments

According to press reports, the president will roll out a $300 billion stimulus package “jobs plan” this week. The plan will contain additional subsidies for state and local government, including money for school construction.

My colleagues Adam Schaeffer and Andrew Coulson have explained that money to build schools is one of the last things that the government school system needs (see here and here). There will probably be money for “hiring teachers” and other targets that the administration thinks will play well with the electorate – not to mention government employee unions.

The electorate – and reporters covering the president’s plan – should understand that subsidies to state and local government have gone through the roof since 2000:

A Cato essay on federal aid to state and local government explains why these subsidies should be abolished, not increased. The following are five fundamental reasons:

1. Subsidies undermine constitutional federalism. The federal government should handle only those issues that are truly national in scope, such as defending the country from attack. The Constitution assigned the federal government specific limited powers, and the 10th Amendment clearly states that “The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.”

2. Subsidies destroy the concept of the states being “laboratories of democracy.” The beauty of “fiscal federalism” is that it allows the states to experiment and figure out what does and doesn’t work. It also allows citizens to live in a state with policies that match their preferences. Federal subsidies stifle this experimentation and limit the choices available to citizens.

3. Subsidies fuel burdensome regulations and bureaucratic waste. The federal government creates countless regulatory hoops that the states have to jump through in order to get the federal handouts. The rules and regulations naturally spark an explosion in bureaucracy at all levels of government. When I was a budget official in the state of Indiana, I saw firsthand the federal and state taxpayer money being wasted trying to administer programs funded with federal dollars.

4. Subsidies misallocate taxpayer resources. Federal aid misallocates resources because the money is distributed on the basis of political, rather than economic, considerations. Congress uses complex formulas to disburse money to the states that ensure that just about everyone gets a piece of the pie. Spreading the largesse across many congressional districts and states helps secure the votes necessary to ensure that the programs are continued. For example, federal community development subsidies were originally intended for poor areas, but now the money goes to poor, middle-class, and rich areas alike.

5. Subsidies breed irresponsibility and waste. Federal politicians and bureaucrats waste a lot of money for the simple reason that it isn’t their money. Federal subsidies exacerbate the problem at the state and local level: not only are state and local officials playing with other people’s money – they’re playing with money that they didn’t have to tax from their citizens. And because state and local citizens weren’t taxed to pay for these federally funded activities, they have less incentive to pay attention to how the money is spent.

Tad DeHaven is a budget analyst on federal and state budget issues for the Cato Institute. Previously he was a deputy director of the Indiana Office of Management and Budget. DeHaven also worked as a budget policy advisor to Senators Jeff Sessions (R-AL) and Tom Coburn (R-OK). In 2010, he was named to Florida Governor Rick Scott’s Economic Advisory Council.

His articles have been published in the Washington Post, Washington Times, New York Post, Wall Street Journal Online, National Review and Politico.com. He has appeared on the CBS Evening News, CNBC, Fox News Channel, Fox Business Channel, and NPR.

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: