Obama’s Tire Tariffs Cost Consumers $1 Billion and $900k Per Job in 2011

“Studies repeatedly show that the consumer cost of trade protection typically exceeds, by a wide margin, any reasonable estimate of what a normal jobs program might cost.”

By Mark J. Perry

From the introduction of the research article “US Tire Tariffs: Saving Few Jobs at High Cost” by Gary Clyde Hufbauer and Sean Lowry of the Peterson Institute for International Economics (emphasis mine):

“In his 2012 State of the Union address, President Obama claimed that “over a thousand Americans are working today because we stopped a surge in Chinese tires.” The tire tariff case, decided by the president in September 2009, exemplifies his efforts to get China to “play by the rules” and serves as a plank in his larger platform of insourcing jobs to America.

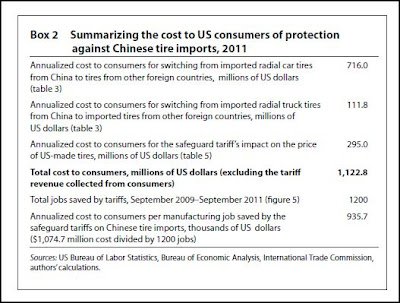

However, our analysis shows that, even on very generous assumptions about the effectiveness of the tariffs, the initiative saved a maximum of 1,200 jobs. Our analysis also shows that American buyers of car and truck tires pay a hefty price for this exercise of trade protection. According to our calculations, explained in this policy brief, the total cost to American consumers from higher prices resulting from safeguard tariffs on Chinese tires was around $1.1228 billion in 2011. The cost per job saved (a maximum of 1,200 jobs by our calculations) was at least $900,000 in that year (see table above). Only a very small fraction of this bloated figure reached the pockets of tire workers. Instead, most of the money landed in the coffers of tire companies, mainly abroad but also at home.

The additional money that US consumers spent on tires reduced their spending on other retail goods, indirectly lowering employment in the retail industry. On balance, it seems likely that tire protectionism cost the US economy around 2,570 jobs, when losses in the retail sector are offset against gains in tire manufacturing. Adding further to the loss column, China retaliated by imposing antidumping duties on US exports of chicken parts, costing that industry around $1 billion in sales.”

MP: The authors point out “While this figure ($900,000 per job saved) seems extravagant, it is consistent with prior research. Studies repeatedly show that the consumer cost of trade protection typically exceeds, by a wide margin, any reasonable estimate of what a normal jobs program might cost.” In other words, it would cost the economy much less overall to not impose the tire tariffs and instead direct compensation towards workers in the tire industry in some other way.

In fact, it would have been cheaper to just idle the 1,200 tire workers and pay them their full salary, of let’s say $75,000 per year, than to impose tariffs that cost the economy almost $1 million per worker. This is a good example of why economists don’t as a group support trade protection and instead favor free trade: the total costs of protectionism always outweigh the total benefits to the protected industry, resulting in a net loss and making the overall economy worse off, not better off.

HT: Gene Hayward

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: