The rich DO pay their fair share

We hear all the time that the “rich don’t pay their fair share of taxes” (123,000 Google search results for that phrase). Here’s an analysis using recent IRS data that suggests otherwise.

By Mark J. Perry at Carpe diem

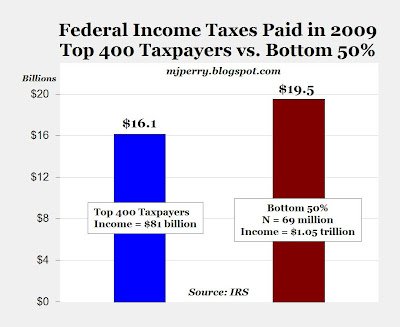

Top 400 Taxpayers Paid Almost As Much in Federal Income Taxes in 2009 as the Entire Bottom 50%

We hear all the time that the “rich don’t pay their fair share of taxes” (123,000 Google search results for that phrase). Here’s an analysis using recent IRS data that suggests otherwise.

1. In 2009, the top 400 taxpayers based on Adjusted Gross Income earned $81 billion as a group, and paid $16.1 billion in federal income taxes (see chart above).

2. In 2009, the bottom 50% of taxpayers, a group totaling 69 million, earned collectively more than $1 trillion and paid $19.5 billion in federal income taxes (see chart above).

Bottom Line: A small group of 400 of America’s most successful earners in 2009, about the number of residents living in a typical apartment building in Washington, D.C., paid almost as much in federal income taxes as the entire bottom half of America’s 138 million tax filers, which is a population equivalent to the combined number of residents living in America’s 29 least populated states, plus the District of Columbia. What makes this disparity possible is the fact that an estimated 47% of individual income tax returns filed in 2009 had a zero or negative tax liability.

When you have only 400 Americans paying almost as much in federal income taxes as the entire bottom 50% of American filing income tax returns, I think we can dismiss any notion of the rich not paying their fair share of taxes. In fact, the IRS should publish the names and addresses of the Top 400 (or to protect anonymity, agree to provide a forwarding service), so that we can all send them “Thank You” letters to express our gratitude for shouldering such a disproportionate share of our collective tax burden.

[And this:]

Significant Turnover in the Top 400 U.S. Earners; From 1992-2009, 85% Were in Just 1 or 2 Years

| Number of Years in Top 400 | Number of Taxpayers in Group | Percent of Taxpayers Represented by Each Group | Number of Returns in total Top 400 over 18-year Period | Percent of Returns Represented by Each Group |

|---|---|---|---|---|

| 1 | 2,824 | 72.99% | 2,824 | 39.22% |

| 2 | 458 | 11.84 | 916 | 12.72 |

| 3 | 181 | 4.68 | 543 | 7.54 |

| 4 | 113 | 2.92 | 452 | 6.26 |

| 5 | 67 | 1.73 | 335 | 4.65 |

| 6 | 55 | 1.42 | 330 | 4.58 |

| 7 | 37 | 0.96 | 259 | 3.6 |

| 8 | 29 | 0.75 | 232 | 3.22 |

| 9 | 18 | 0.47 | 162 | 2.55 |

| 10 or more | 87 | 2.25 | 1,147 | 15.93 |

| Total | 3,869 | 100% | 7,200 | 100% |

The IRS has a new report on the 400 taxpayers reporting the highest adjusted gross incomes (AGI) from 1992 to 2009, and the table above shows the frequency of appearing the “Fortunate 400” over the entire period (Table 4 in the IRS report). The 7,200 tax returns (400 highest earners x 18 years) from 1992 to 2009 represented 3,869 unique, individual taxpayers, since some taxpayers made it into the top 400 earner group more than one year. The data show that:

1. Of the group of 3,869 top earners from 1992-2009, 2,824 individuals made it into the “Fortunate 400” only one time during the 18-year period. Those 2,824 one-timers represent about 73% of the total (3,869), so only about one out of every four, or 27% of the total, made it into the top 400 more than once between 1992 and 2009 (see columns 2 and 3 above).

2. Moreover, 2,824 earners made it into the top 400 once (73%), and another 458 ( about 12%) made it into the top group twice. So 85% made it into the “Fortunate 400” group either once or twice, and only about 15% made it into the top group more than twice.

3. There were only 87 taxpayers out of the 3,869 total taxpayers in the group (2.25%) who were in the top 400 in 10 or more years.

4. Of the 7,200 total returns filed over the 18-year period, 2,824 represent one-timers, so on average in any given year, about 40% of the returns are filed by taxpayers who are not in the “Fortunate 400” in any of the other 17 years (see last two columns). And more than half of the total 7,200 “Fortunate 400” returns between 1992-2009 (3,740 and 52%) were filed by taxpayers whose returns only appeared in one or two of the 17 years.

According to the IRS, “The data reveal a mostly changing group of taxpayers over time. In fact, there were 3,869 different taxpayers represented in total for the 18-year period. Of these, a little more than 27 percent appear more than once and slightly more than 2 percent were represented in 10 or more years.”

MP: Whenever we hear commentary about the top or bottom income quintiles, or the top or bottom X% by income, or the top 400 taxpayers, a common assumption is that those are static, closed, private clubs with very little turnover – once you get into a top or bottom quintile, or a certain income percent, or the top 400, you stay there for decades.

But reality is very different – people move up and down the income quintiles and percentage groups throughout their careers and lives. The top or bottom 1/5/10%, just like the top or bottom quintiles, are never the same people from year to year, because there is constant, dynamic turnover as we move up and down the income categories. As the new IRS data show, almost three out of every four members of the ever-changing, dynamic “Fortunate 400” over the last 18 years were only “members” of that group for a single year.

Dr. Mark J. Perry is a professor of economics and finance in the School of Management at the Flint campus of the University of Michigan. Perry holds two graduate degrees in economics (M.A. and Ph.D.) from George Mason University near Washington, D.C. In addition, he holds an MBA degree in finance from the Curtis L. Carlson School of Management at the University of Minnesota. In addition to a faculty appointment at the University of Michigan-Flint, Perry is also a visiting scholar at The American Enterprise Institute in Washington, D.C. he blogs a Carpe Diem.

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: