Obama Plans Another Housing Collapse?

The federal government is beginning another initiative to force banks to lend mortgage money to low-credit-rated blacks and Hispanics — specifically blacks and Hispanics — and is threatening and already imposing punitive fines if they don’t.

By Elephant’s Child at American Elephant’s

Barack Obama has claimed that the financial crisis was caused by all the  money George W. Bush spent on “a dumb war” and the tax-breaks he gave only to the rich, or something like that. But most people, I think, recognize the collapse of the housing bubble. It began with liberals’ conviction that banks wouldn’t lend to blacks and Hispanics because they were racist. They called it “Redlining.” Studies showed that the denial of loans was related to the inability of customers to pay the loans back, but everybody thought that encouraging more Americans to own their own homes was a very good thing. Home ownership meant that people would be more involved in good communities, and good schools.

money George W. Bush spent on “a dumb war” and the tax-breaks he gave only to the rich, or something like that. But most people, I think, recognize the collapse of the housing bubble. It began with liberals’ conviction that banks wouldn’t lend to blacks and Hispanics because they were racist. They called it “Redlining.” Studies showed that the denial of loans was related to the inability of customers to pay the loans back, but everybody thought that encouraging more Americans to own their own homes was a very good thing. Home ownership meant that people would be more involved in good communities, and good schools.

They passed the Community Reinvestment Act so that banks were forced to reduce down payments and lend to a lot of people that would not get loans under normal prudent rules of banking. And when not enough minorities were owning their own homes, they pushed a little harder on the banks. Fannie Mae and Freddie Mac bundled those mortgages and sold them to Wall Street Investment houses who sold them to investors around the world, and when it became clear that people weren’t going to be able to pay their mortgages, banks everywhere were left holding the bag, and the Wall Street investment houses either went under of had to be bailed out by the federal government.

This cost the taxpayers close to a trillion dollars and put the economy in a hole, in which we remain, because the administration was more interested in “transforming America” than in doing the things necessary to heal the economy. Liberals said it was all the banks’ fault for “deceiving” all those poor people into thinking they could afford to buy homes, and the banks should be punished and those poor people should be allowed to keep their homes anyway. Big lesson for us all to learn.

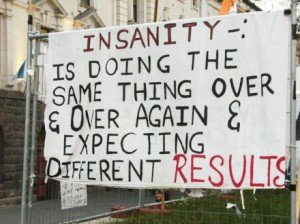

Except they didn’t learn anything, and they are about to do it all over again.

The federal government is beginning another initiative to force banks to lend mortgage money to low-credit-rated blacks and Hispanics — specifically blacks and Hispanics — and is threatening and already imposing punitive fines if they don’t. This time they are going even farther, and are going to take over the credit rating agencies and force them to change their standards to accommodate blacks and Hispanics so that nobody will be able to tell who is a bad credit risk and who is not. The federal government is going to impose its will on the home-loan industry and force another round of bad loans, because they believe everything is about race.

This time the program comes from the brand-new Consumer Finance Protection Bureau, headed by the illegally appointed Richard Cordray, [without Senate approval when the President claimed the Senate was in recess because he said so, but it wasn’t]. Authorized by the disastrous Dodd-Frank bill, it has suddenly acquired 900 employees. The CFPB has just announced that it is adopting a 20-page “Policy Statement on Discrimination in Lending.”

Two weeks ago, Wells Fargo gave in to a Justice Department offensive and paid $175 million for “alleged past discriminating against minority borrowers.” The bank had received an “outstanding” grade in its most recent Community Reinvestment Act exam. The government did not bother to prove discrimination in a single instance but relied instead on statistics showing lower rates of homeownership in minority neighborhoods. The Justice Department ‘s Thomas Perez, who heads the campaign, says banks discriminate “with a smile” and “fine print” and are “every bit as destructive as the cross burned in a neighborhood.” Interesting language.

Two weeks ago, Wells Fargo gave in to a Justice Department offensive and paid $175 million for “alleged past discriminating against minority borrowers.” The bank had received an “outstanding” grade in its most recent Community Reinvestment Act exam. The government did not bother to prove discrimination in a single instance but relied instead on statistics showing lower rates of homeownership in minority neighborhoods. The Justice Department ‘s Thomas Perez, who heads the campaign, says banks discriminate “with a smile” and “fine print” and are “every bit as destructive as the cross burned in a neighborhood.” Interesting language.

There are some simple rules for escaping poverty in America. Graduate from high school, don’t get married until after you graduate, don’t have babies until after you get married, and stay off drugs. Works most every time.

Combine this exciting new program with the president’ new budget that aims to spend $46.2 trillion over the next ten years. Add in the fact that this is a 57 percent increase over today’s spending levels and the budget proposes to have debt remaining permanently above 100 percent of GDP. And some people actually propose to vote for this man because he is “likeable.” Have we reached such a point?

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: