Fiscal Cliff Notes: What It Really Means for Citizens

You’re likely to pay more in taxes in one way or another (especially if you are high-income), and you’ll see cuts to government programs. But we won’t literally fall off a cliff. And while the debt and deficit will be reduced, our government will still spend more than it takes in, so our larger problems won’t be resolved.

by Kevin Palmer at Watchdog Wire

Even the brightest political minds may stumble over their words when asked about the fiscal cliff. Although it’s common knowledge that our country faces a serious debt issue, and the term “fiscal cliff” has entered our lingo over the past several months, :

Q: So what is this “fiscal cliff?” Haven’t we been spending ourselves off a cliff for a long time now?

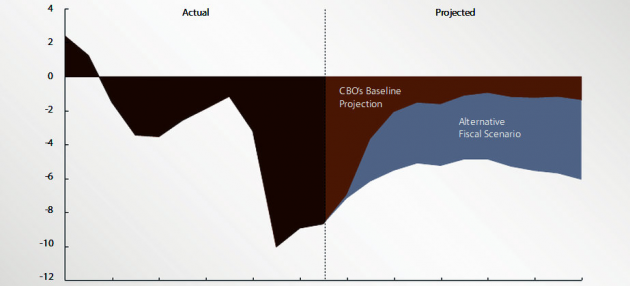

The fiscal cliff is a result of last summer’s debt crisis (which, in turn, was a result of years of reckless borrowing and wasteful spending). Because the President and Congress couldn’t agree on a deal then to cut the debt and reduce the deficit, they decided to schedule some drastic tax increases and spending cuts for January 1, 2013, hoping they could reach a deal by that time. These taxes and cuts are called the “fiscal cliff” because they will drastically reduce our deficit–so much that, if shown on a graph, the size of the deficit would seen to drop off a cliff. If the politicians can’t work out a better deal to cut the debt by New Year’s Eve, the fiscal cliff will go into effect.

(Also: check out this chart from The Washington Post to see a visualization of the cliff.)

Q: Does this mean my taxes are going to go up?

Yes–in more ways than one. The fiscal cliff would end the Bush tax cuts of 2001 and 2003, as well as the temporary payroll tax cuts passed by President Obama. The estate tax–popularly known as the death tax–and taxes on capital gains from investments will also rise. Also, the fiscal cliff would make as many as 30 million more Americans subject to something called the Alternative Minimum Tax–an additional tax on people the government deems are not paying enough taxes already!

Q: President Obama says he wants to make the rich pay their fair share. Is that what’s about to happen?

Well, it depends on what you consider a “fair share”–but more importantly, the fiscal cliff means higher taxes on everyone, no matter how rich or poor. In fact, the higher payroll taxes–money taken directly out of your paycheck–will be more trouble for people who earn a salary than for “millionaires and billionaires.”

Q. Income taxes, payroll taxes, death tax, capital gains tax, Alternative Minimum Tax–anything else?

Glad you asked. The first round of new taxes from President Obama’s health law will also go into effect on New Year’s Day.

Q. Those taxes sound ridiculous–can’t we cut spending instead?

Of course. The fiscal cliff includes spending cuts call “sequestration,” which will slice defense spending by almost 10% and most other “discretionary” programs by similar amounts. However, the package will reduce spending by only 0.25%–while raising taxes by as much as 19%.

Q. How is that possible: only 0.25% cuts in spending, while cutting many programs by almost 10%?

That’s because the fiscal cliff leaves Social Security alone and makes only small cuts to Medicare, despite the fact that entitlements accounted for 62% of federal spending this year. (Defense, which will be cut by as much as half a trillion dollars, made up 19% of spending in 2012.) However, as many as 2 million people will lose unemployment benefits, and many of these folks also rely on other federal programs that will be cut.

Q. So is that it? Can we do anything to prevent this from happening?

Yes–if you trust President Obama and Congress to reach a deal by the end of the year. “Going over the fiscal cliff” means not cutting a deal, and facing the new taxes and spending cuts described above.

Q. What is President Obama suggesting?

President Obama’s plan–an alternative to the fiscal cliff–includes $1.6 trillion in new taxes, targeted mostly at families making over $250,000. He wants to raise taxes on capital gains and dividends–in other words, taxes on successful investments. Obama’s plan makes steep cuts to Medicare, requiring seniors to pay more out of pocket–but not until 2017, after he leaves office. Finally, Obama’s plan cuts $800 billion from the military, which the White House claims can be accomplished with the end of the wars in Afghanistan and Iraq.

Q. Wait–President Obama’s cutting spending?

He is. Then again, his plan also calls for another stimulus.

Q. What is the Republican plan?

John Boehner, the Speaker of the House, wants to raise $800 billion in tax revenue (half of Obama’s plan) by closing loopholes and ending deductions for the wealthy. The rest of his plan involves cuts and reforms to entitlement programs, and general cuts to other federal programs.

Q. So whose plan raises my taxes more?

If you’re middle-income or lower, the Obama and Boehner plans both claim to keep your tax rates where they are–although everyone will feel the crunch from the new Obamacare taxes and the end of the temporary payroll tax cut. However, either plan is better for middle-income Americans than “going off the cliff,” which raises several taxes for all Americans. Wealthy Americans will pay more taxes than they do now if the Boehner plan passes, and even more if the Obama plan does.

Q. Which plan will pass–Obama’s or Boehner’s?

Neither. The parties have rejected each other’s plans, making it likelier that we will go off the cliff. But there’s still time to strike a deal, which would likely include more taxes on high earners, fewer deductions, and cuts to Medicare, Social Security, and other programs.

Q. What is Simpson-Bowles? I’ve heard that phrase in the news a few times.

In 2010, the President and Congress put together a bipartisan panel to come up with a plan to avoid the debt crisis and fiscal cliff. This plan, named Simpson-Bowles after the Republican and Democrat who wrote it, includes more new taxes than either the Obama or Boehner plans, cuts to defense, a new national gas tax, and a broad reform of the tax code. The Simpson-Bowles plan wasn’t approved by the panel, and was rejected in Congress in a very lopsided vote.

Q. Why do politicians keep talking about Simpson-Bowles, if they already voted against it?

Both sides are against Simpson-Bowles, so both sides can blame the other for opposing it! It’s all a political game.

Q. Bottom line–if we go over the fiscal cliff, or if we pass a deal, what will happen to my family?

You’re likely to pay more in taxes in one way or another (especially if you are high-income), and you’ll see cuts to government programs. But we won’t literally fall off a cliff. And while the debt and deficit will be reduced, our government will still spend more than it takes in, so our larger problems won’t be resolved.

Q. Thanks for ruining my morning, Kevin. Anything else?

Many economists think that the severity of the new taxes and spending cuts will force our economy into a double-dip recession. (Don’t shoot me!)

Kevin Palmer is a staff writer at Franklin Center. Contact him at kevin@watchdogwire.com

Also please consider:

Has Obama Already Bankrupted America?

The Decline and Fall of America

European Socialist Collapse Is Obama’s Plan for America

Obama Has Stolen $5.3 Trillion From Our Children In Order To Make Himself Look Good

Debt quotes

The “Fiscal Cliff” is the People’s Fault

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: