National Debt Is Still the Biggest Threat to Our National Security

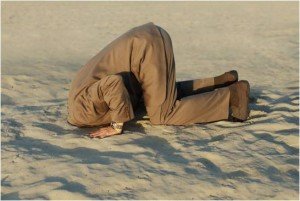

Americans are in denial about the simple fact that our national debt is the biggest threat to our national security.

By Ileana Johnson Paugh

“An unlimited power to tax involves, necessarily a power to destroy, because there is a limit beyond which no institution and no property can bear taxation.” – John Marshall

Americans are in denial about the simple fact that our national debt is the  biggest threat to our national security. National debt grew exponentially from Washington’s profligate deficit spending, recessions, and wars.

biggest threat to our national security. National debt grew exponentially from Washington’s profligate deficit spending, recessions, and wars.

When I looked today at the national debt clock, each taxpayer owed approximately $142,000, the figure changing rapidly based on factors such as the value of the dollar, trade deficits, and the latest sums borrowed from U.S. taxpayers or from whatever country willing to buy our Treasury Securities, T-bills, T-notes, and T-bonds – China, Japan, and oil exporters being the largest buyers of U.S. debt so far.

The national debt to most Americans is something on paper in a faraway place that does not concern or affect us. Americans have no idea how it grew so exponentially large, where it came from, who owes it, who owns it, and how many zeroes a trillion has.

Perhaps the debt figure would become more real to Americans and take on dire significance if each taxpaying citizen would receive a bill for $142,000 payable in full right now, no kicking the can down the road to our children and grandchildren in exchange for our current comfort.

It is true, our national debt is measured in dollars, which we can always print in order to meet our payments. This is called monetizing the deficit. Doing so, however, creates inflation, as too much money is chasing too few goods. A responsible government should never print money in outlandish excess of GDP, the amount of final goods and services produced in a year. If they do, hyperinflation will occur, and severe devaluation of the currency.

“Since 1971, U.S. borrowed $50 trillion to produce only $13 trillion of goods and services in a 40 year period.” Egon von Greyerz, a financial analyst with Matterhorn Asset Management AG in Zurich, Switzerland, said, “From 1971 when President Nixon ended the gold-backing of the dollar, virtually all of the growth in the Western world has come from the massive increase in credit rather than from real growth in the economy.”

The mantra that the “rich are not paying their fair share” promoted by the MSM sound bites and the Democrat ruling party prompted many to calculate what would happen if we were to confiscate every millionaire and billionaire’s wealth, what impact would have on our national debt, the accumulated budget deficits of previous years. All the U.S. accumulated wealth would last a mere two months.

There is a difference between income and wealth. The Democrats are talking about taxing the rich (income), not taxing the wealth – big difference which voters clearly do not understand. Taxing income will result in “spreading the wealth” from producers to takers in the name of “social justice” and the subsequent consumer spending, with no tangible assets created. Excessive tax discourages capital formation and job creation, stifling economic growth. Perhaps that is the political intent of the ruling party.

Taxing the rich already brings in the lion’s share of revenue to the Treasury. If the rich are taxed too much, who is going to create manufacturing jobs, the government?

Average earners and small businesses that pay taxes at the personal income tax level are now the rich – the middle class will be taxed more when the Bush era tax cuts expire and the Obamacare taxes will go into effect in January 2013, contracting job creation. The Democrats and the President have no intention or concrete plans to cut spending. Their main goal seems to be tax increases.

According to Mark Steyn, if the government was to confiscate all of the $44 billion that Warren Buffett has, it would only last four days at the current level of spending.

Much ado has been made in the press about Warren Buffet who did not pay the same tax percentage as his secretary. When Mr. Buffett complained, I was not clear what kept him from writing a “fair share” check to the IRS, matching his secretary’s percentage.

Mark Steyn calculated again that, if everyone’s tax indebtedness would go up according to this Buffett rule, the deficit created by the Obama administration in 2011 would be paid off in 514 years and we would still have the deficits created in the other three years of this presidency.

The national debt has exceeded $16.3 trillion but Gross Domestic Product (all the final goods and services produced in a year domestically) is only $15.3 trillion, one trillion short. The federal revenue from taxes is $2.4 trillion. We have spent almost 7 times what we raise in taxes annually.

The problem is not that Americans, rich or poor, are not paying enough taxes, the problem is that Congress and this administration are spending too much money. Spending to GDP ratio is 41 percent.

We have paid so far in 2012 almost $4 trillion in interest from excessive borrowing when our money supply from cash and savings is $10.3 trillion.

Our national debt has exploded in the last four years. During President Obama’s first three years in office, it grew by $4.7 trillion, an increase of 45 percent. (factcheck.org)

Our current policy seems to be putting pressure on the U.S. dollar until two options remain – default on the U.S. debt, or monetizing it by printing more money. If we default, as in any case of bankruptcy, creditor nations would demand payment in American assets – our oil fields, mines, land, parks, monuments, buildings, military bases, and even the indentured servitude of generations of taxpayers.

Our current policy seems to be putting pressure on the U.S. dollar until two options remain – default on the U.S. debt, or monetizing it by printing more money. If we default, as in any case of bankruptcy, creditor nations would demand payment in American assets – our oil fields, mines, land, parks, monuments, buildings, military bases, and even the indentured servitude of generations of taxpayers.

Can we refuse to pay our national debt? We could but the consequences might not be so pleasant. Britain, Germany, and Italy blockaded the ports of Venezuela during the Venezuelan Crisis of 1902-1903 when dictator Cipriano Castro refused to pay foreign debts and damages suffered by European citizens in the Venezuelan civil war.

Defense Secretary Leon Panetta said the following during the November 20 speech to the Center for a New American Security (a think-tank in Washington):

“One of the national security threats is the question of whether or not the leaders we elect can, in fact, govern and can, in fact deal with the challenges that face this country.” (Emelie Rutherford, Defense Daily, November 26, 2012)

Secretary Panetta was initially questioned during this meeting why the Senate failed to pass the Law of the Sea Treaty (LOST). Most Americans are actually glad that LOST was not ratified since it is part of U.N. Agenda 21’s plan of global governance.

Sequestration may not be such a good idea when it involves the military. Si vis pacem, para bellum, the Romans said, “if you want peace, prepare for war.”

Panetta acknowledged that budgeting “can’t just be about cutting, it’s got to be about investing, investing in space and cyber, investing in unmanned systems, investing in the kind of capability to mobilize quickly if we have to. And most importantly, maintaining our defense industrial base in this country so that we are not in a position where I’m forced to contract out the most important defense capabilities that I need. I can’t do that. I can’t just contract those out to another country. I’ve got to have that capability here in the United States.”

National debt is the number one threat to national security. If we keep squandering trillions of dollars borrowed from our potential foes and have nothing to show for our spending, except increasing dependency of our population on welfare, food stamps, and entitlements, if we cut NASA and rent space on Russian flights, if we spend so much that we are no longer able to invest in infrastructure, technology, medicine, space exploration, industry, manufacturing, and defense, our integrity as a powerful nation is severely threatened and damaged.

Dr. Ileana Johnson Paugh, ( Romanian Conservative) ( Romanian Conservative) is a freelance writer (Canada Free Press, Romanian Conservative, usactionnews.com), author, radio commentator (Silvio Canto Jr. Blogtalk Radio, Butler on Business WAFS 1190, and Republic Broadcasting Network), and speaker. Her book, “Echoes of Communism, is available at Amazon in paperback and Kindle. Short essays describe health care, education, poverty, religion, social engineering, and confiscation of property. A second book, “Liberty on Life Support,” is also available at Amazon in paperback and Kindle. Her commentaries reflect American Exceptionalism, the economy, immigration, and education.Visit her website, ileanajohnson.com. Get her new book at Amazon, “U.N. Agenda 21: Environmental Piracy,” everything you ever wanted to know about Agenda 21 and some.

Also please consider:

Has Obama Already Bankrupted America?

The Decline and Fall of America

European Socialist Collapse Is Obama’s Plan for America

Obama Has Stolen $5.3 Trillion From Our Children In Order To Make Himself Look Good

Debt quotes

Obama’s Achievement – Gov’t Has Become Gigantic Wealth-Transfer Machine

Obama sued banks to give subprime loans to Chicago’s African-Americans

A billion here a trillion there, soon you’re talking about real money

People who will vote for Obama still believe what he says

Obama Has Stolen $5.3 Trillion From Our Children In Order To Make Himself Look Good

Debt Now $16 TRILLION and Climbing Fast

Debt quotes

Mark Levin: Obama is a Marxist

Debt Jumps More Than $1T for 5th Straight Fiscal Year

Fed’s holding of US debt up 452% under Obama

After the Sovereign Debt Crisis Comes the Deleveraging

Politicians as Economic Arsonists

Too Much Debt: Our Biggest Economic Problem

California and Illinois are living in Obama’s second term

Twenty-Nine Reasons to Be Angry And/Or Scared – Still

The Real End Game, We’re Coming To The End

Obama leads “Forward” to ruin and destruction

Not Worth a Continental

So you think we’re better off?

New report – Billion$ in Obama’s auto bailout went to rich unions

Spending and debt causing global slowdown

Fed’s holding of US debt up 452% under Obama

Beck Explains Why the Federal Reserve Is a Complete ‘Scam’

Obama’s real spending record

By Incentivizing Debt, We’ve Guaranteed Debt-Serfdom and Stagnation

CBO: spending binge endangers our children’s future

Dangers of Government Dependency – Econ 101

Sen. Dirksen Left Vs Right in 1964

CBO Agrees: Less debt, lower tax rates good for economy, jobs & growth

Leftists call for more of the same – spending and debt

Potential Victories for Individual Rights in 2012

Please Excuse My (Failed) President

Obama campaign panicking over bad economic news – “not a single idea” – Krauthammer

On Shills, Technocrats, Politicians and the Sinking Ship

Economy tanking under Obama

You lie! Krauthammer: Obama spending claim “unbelievable distortion of the truth”

Why Obama Failed

U.S. Set to Lead World Over Debt Cliff Into Recession

Rubio: “Do people back home fully understand”

Government has doubled since 2001 – Sen. Coburn

Obama railed against deficits until he became radical record breaking big spender

The other Obama on PAYGO

Obama’s $5 Trillion Moment

Paul Ryan: President’s failed policies causing record poverty

Gov. Mitch Daniels: Debt ‘Will Lead to National Ruin’

U.S. Student Debt To Reach $1.4 Trillion by 2020

34 Shocking Facts About U.S. Debt That Should Set America On Fire With Anger

King of debt

Return to Debt Mountain

15 Trillion Dollars In Debt, 45 Million Americans On Food Stamps And Zero Solutions On The Horizon

Obama warns Americans not to panic while he ruins the economy

What Do You Believe — Cash or Government Propaganda?

National debt really $24 TRILLION

THE FALLACY OF A RETURN TO NORMALCY

42% See U.S. Debt Default Somewhat Likely in Next 5 Years

New Obama Record – Debt Growth to Top Economic Growth for Decade

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: