U.S. Set to Lead World Over Debt Cliff Into Recession

America is set to push the global economy right into the tank. The non-US members of the G8 are well aware of these facts. They must be crapping in their pants at the prospects.

By Bruce Kasting

I wish I could have been a fly on the wall at the G8 summit at Camp David this  weekend. The final communiqué from the global big shots talks about keeping Greece in the Euro and a shift away from austerity and a move towards growth oriented policies. Forget the Happy Talk, I want to know what they were really saying.

weekend. The final communiqué from the global big shots talks about keeping Greece in the Euro and a shift away from austerity and a move towards growth oriented policies. Forget the Happy Talk, I want to know what they were really saying.

Obama must be praying for a miracle with the other members of the G8. If we get a “Grexit”, there will be months of turmoil in the global capital markets before the dust settles. The last thing the Big O wants to have is a recession in Europe that infects the USA with lower growth and higher unemployment when Americans are going to the polls in six months. For the same reason, Obama needs Japan to keep QEing and spending money it does not have.

Obama must be praying for a miracle with the other members of the G8. If we get a “Grexit”, there will be months of turmoil in the global capital markets before the dust settles. The last thing the Big O wants to have is a recession in Europe that infects the USA with lower growth and higher unemployment when Americans are going to the polls in six months. For the same reason, Obama needs Japan to keep QEing and spending money it does not have.

Obama may be a slave to what happens outside of our borders during the period prior to the election, but those same foreign leaders are completely at the mercy of the USA and the next President after the election. It won’t matter what the UK, Germany, France or Japan does with stimulus in their countries; what’s on the table in the USA will overwhelm any of those efforts.

The USA is months (220 days) away from initiating fiscal policies that will trigger a recession in the US that will be at least as severe as that experienced in 2008. With the rest of the world already teetering on recession, America is set to push the global economy right into the tank. The non-US members of the G8 are well aware of these facts. They must be crapping in their pants at the prospects.

I think those concerns are completely justified. Any foreign leader who is banking on the hopes that America will end its political stalemate and put forward a credible economic plan that puts the US and global economies on a better footing is a fool. If you want proof of just how far away viable compromises are, consider some legislation put forward by Republican leaders this week.

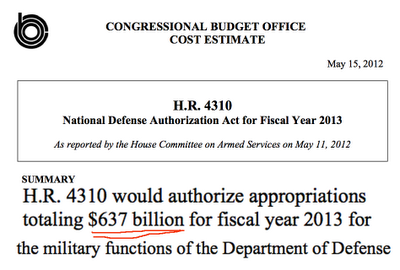

House Representative “Buck” McKeon (R.Ca) runs the powerful Armed Services Committee. He has come up with a fiscal 2013 spending plan for the military. The CBO looked at H.R. 4310, so did the White House. It’s a joke.

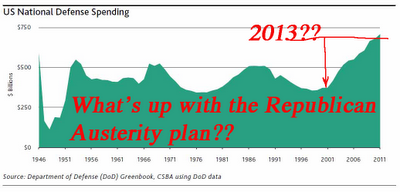

$637 billion! That’s a lot of loot for a country that’s tapped out. This is not a compromise. This is an insult. The following chart shows that the 2013-spending plan proposed by Republicans has no reduction from the historic highs of the past few years.

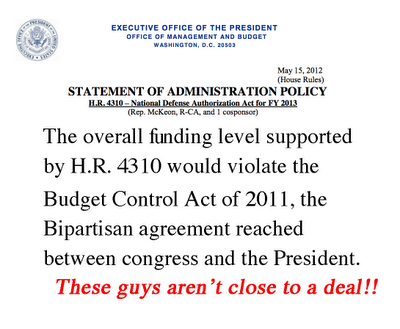

What does the White House have to say about H.R. 4310?

When it comes to military spending, the Republicans want to bust the law that led to the increase in the debt limit. They propose legislation that would renege on the deal that they fought for last summer. The fight over the debt limit brought the economy and the markets to its knees. It cost the USA its AAA. And now the Republicans propose to kiss it away.

Obama had lunch with House Speaker Boehner last week to discuss the political impasse and the critical issues the country faces. To make it look like B&O are just a couple of regular guys they went for a bite to a local sandwich shop. I’m thinking there must have been 300 Secret Service types outside. There is nothing regular about these guys.

Obama had lunch with House Speaker Boehner last week to discuss the political impasse and the critical issues the country faces. To make it look like B&O are just a couple of regular guys they went for a bite to a local sandwich shop. I’m thinking there must have been 300 Secret Service types outside. There is nothing regular about these guys.

Did the “deciders” at the hoagie shop agree on anything? Not a chance.

There is a near zero chance for America to address the fiscal cliff that is coming on Jan 1 before the election. I think there is also a zero chance that it will get resolved in the six-weeks following the vote. Those G8 leaders have every reason to be worried. So should the markets.

- Bruce Krasting

- Westchester, NY, United States

- I worked on Wall Street for twenty five years. This blog is my take on the financial issues of the day. I was an FX trader during the early days of the ‘snake’ and the EMS. Derivatives on currencies were new then. I was part of that. That was with Citi. Later I worked for Drexel and got to understand a bit about balance sheet structure and corporate bonds from Mike Milken. I was involved with a Macro hedge fund later. That worked out all right, but it is not an easy road. There was one tough week and I thought, “Maybe I should do something else for a year or two.” That was fifteen years ago. I love the markets. How they weave together. For twenty five years I woke up thinking, “What am I going to do today to make some money in the market”. I don’t do that any longer. But I miss it. View my complete profile

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: