Obama’s Achievement – Gov’t Has Become Gigantic Wealth-Transfer Machine

This situation will make getting the federal budget under control increasingly difficult, since it will invariably involve pitting those writing checks against those cashing them.”

By Mark J. Perry

The charts above illustrate two disturbing trends that help frame the long-run fiscal challenges confronting the U.S. that far outweigh any possible near-term fallout from the pending “fiscal cliff” that the federal government faces at the end of this year.

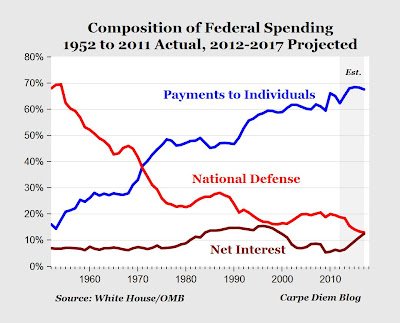

1. The top chart above (data here, see Table 6.1) displays the increasing share of the federal government’s spending on “payments to individuals,” based on actual data from the Office of Management and Budget (OMB) for the years 1952 to 2011 and its projections through 2017.

In 1952, less than one out of every six dollars spent by the federal government represented payments to individuals. By 2010 payments to individuals had increased so dramatically over time that roughly two out of every three dollars (66.1 percent) spent by the federal government in that year were payments to individuals for programs like Social Security, Medicare and Medicaid, public assistance, food and housing assistance, and unemployment assistance. Last year, payments to individuals as a share of federal spending decreased slightly to 65 percent, and that category was more than three times larger than the share of 2011 federal spending on defense (20.1 percent), and more than ten times larger than the share spent by the federal government on interest payments for the national debt (6.4 percent). The OMB estimates that payments to individuals will exceed 68 percent of federal spending in 2014, 2015 and 2016, before falling slightly to 67.5 percent in 2017 when payments to individuals will exceed $3 trillion for the first time.

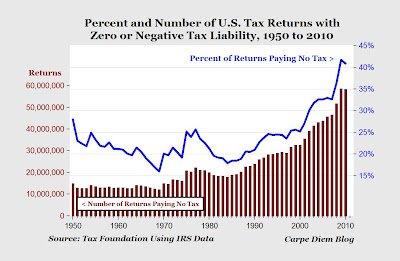

2. At the same time that payments to individual Americans consume an increasing share of federal spending, the burden of taxes to finance federal spending is falling on a shrinking group of American taxpayers. According to a recent study by The Tax Foundation, 41 percent of federal income tax filers in 2010 had a zero or negative federal income tax liability after taking deductions and credits, which was a slight decrease from the previous year when 41.7 percent of tax filers had no tax liability (see bottom chart above). In both years, the number of nonpaying tax filers exceeded 58 million. After fluctuating in a range between roughly 20 and 25 percent for the fifty year period from 1950 to 2000, the percent of Americans filing tax returns but paying no federal income taxes has increased sharply over the last decade to record-setting levels above 40 percent in the two most recent years.

So why does this matter?

Our long-term fiscal problems won’t be fixed until we address what might be our nation’s most serious fiscal-related problem: we’re increasingly becoming a European-style “entitlement nation,” with “payments to individuals” increasing both in absolute dollar amounts and as a share of total federal spending, while at the same time the share of Americans who face a zero or negative federal income tax liability is above 40 percent and rising. In other words, a declining share of American taxpayers is being forced to finance the rising cost of the federal government, which is increasingly being spent on payments to individuals.

John Merline (now at Investor’s Business Daily) described the situation this way in an AOL News editorial last year:

“When you put these two trends together, what you find is that the federal government has over the years essentially turned into a gigantic wealth-transfer machine — taking money from a shrinking pool of taxpayers and giving it out to a growing list of favored groups. This situation will make getting the federal budget under control increasingly difficult, since it will invariably involve pitting those writing checks against those cashing them.”

More recently, AEI’s Nicholas Eberstadt wrote in last Saturday’s Wall Street Journal:

“Within living memory, the federal government has become an entitlements machine. As a day-to-day operation, it devotes more attention and resources to the public transfer of money, goods and services to individual citizens than to any other objective, spending more than for all other ends combined.”

That’s the long-term fiscal cliff that should have us all very concerned – the fact that the federal government over time has turned into a gigantic entitlements and wealth-transfer machine.

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: