Illinois Governor Wants to Borrow $15 Billion to “Balance” the Budget; Illinois Total Unfunded Liabilities Exceed $200 Billion Already

The state of Illinois elected a Keynesian nutcase of epic magnitude in Governor Quinn. Quinn’s latest brainstorm is to borrow $15 billion to “stabilize things”.

By Mike “Mish” Shedlock at Mish’s Global Economic Analysis

The state of Illinois elected a Keynesian nutcase of epic magnitude in Governor Quinn. Quinn’s latest brainstorm is to borrow $15 billion to “stabilize things”.

Quinn has not said how he will pay back the loans. Then again, he does want to raise taxes like mad and probably will do so. Regardless of what he does, Quinn is so beholden to unions, Illinois will need to borrow again 12 months from now.

Please consider Quinn Weighs $15 Billion Illinois Borrowing ‘Option’

Illinois Governor Pat Quinn is considering borrowing $15 billion to pay overdue bills and balance the biggest budget deficit in the state’s history.

Illinois faces a budget shortfall of at least $13 billion because of declining tax revenue. The state Senate in November didn’t have the votes to approve the borrowing of $3.7 billion to cover pension-fund contributions for the fiscal year that ends June 30.

Senate President John Cullerton and House Speaker Michael Madigan declined through spokesmen to say if the bond sale would draw enough support to pass.

The Senate Republican leader, Christine Radogno, criticized the proposal as lacking specifics about how the money would be paid back.

Other ideas under consideration include a 2 percentage- point increase in the state income tax that the Senate approved in 2009. The current rate is 3 percent. The House didn’t take the measure up for a vote.

Quinn’s new borrowing proposal, which the Chicago Tribune reported today, drew criticism from one municipal-bond investor. Matt Dalton, chief executive officer of Belle Haven Investments Inc., in White Plains, New York, questioned the wisdom of borrowing.

“He’s trying to sign up for another credit card,” said Dalton. “That’s going to put a lot of pressure on Illinois.”

The cost of insuring Illinois’s bonds against default rose to the highest level in five months as the state headed for the new year without a plan to finance the pension-fund contributions.

Illinois Needs Over $200 Billion Not $15 Billion

Illinois current budget deficit is $13 billion. However, Illinois debt including pension underfunding is $130 billion for fiscal year 2009.

I talked about this 10 months ago in Illinois Pension Fund $61 Billion Underwater; State Borrows Money For 2010 Contribution; California $20 Billion in the Hole Again

Illinois’s pension fund is deep in the hole and getting deeper every year.

The state’s reaction never changes: borrow money and hope the returns beat the cost of borrowing. Former governor Rod Blagojevich tried that to the tune of $10 billion and it worked out less than spectacularly to say the least. Nonetheless Illinois is back at it for 2010.

Illinois Is Broke

Inquiring minds are looking at Illinois Is Broke, a website mentioned in the above article.

By July, Illinois will be $130,000,000,000 in debt. This crushing load hampers the state’s ability to fund public schools and universities, health care, and other essential public services. Most of that money is owed to the state’s pension funds and retiree health care plans. And YOUR SHARE of that debt is $25,000 per household.

How did this happen? Basically, Illinois spends $3 for every $2 it takes in. Only in Springfield is this kind of math possible. The state accomplishes this by borrowing or by simply ignoring its unpaid bills. And it has been doing so for years.

Here are a couple charts from the site. Click on either charts to see a sharper image.

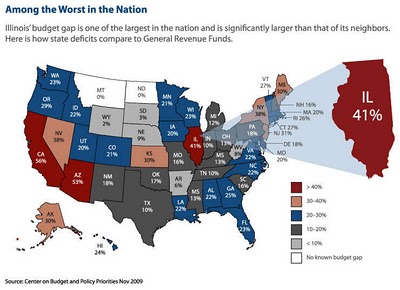

Illinois Budget Gap

Illinois Needs Over $200 Billion Not $15 Billion

Flash forward to fiscal year 2010 and take a look at Illinois pension liabilities as shown in Interactive Map of Public Pension Plans; How Badly Underfunded are the Plans in Your State?

Illinois pensions alone are $208 billion underfunded using realistic measures. The overall level of funding is 29%, the worst in the nation.

Click on the above link to see how your state fares.

Governor Quinn’s Crazy Borrowing Plan Makes State’s Problem Worse

Please consider this email from John Tillman at the Illinois Policy Institute.

Governor Quinn’s Crazy Borrowing Plan Makes State’s Problem Worse

CHICAGO – Governor Quinn’s borrowing plan will worsen the state’s fiscal health, not improve it, notes the nonpartisan Illinois Policy Institute. The independent think tank points out that while borrowing now might give the state some temporary breathing room, the funding of core government services will be threatened in the future as the cost of debt service mounts.

“Governor Quinn’s borrowing will hit the working class, poor, and disadvantaged of Illinois the hardest,” said John Tillman, CEO of the Illinois Policy Institute. “Borrowing costs, combined with annual increases in the expected pension contribution, will crowd out basic government functions in the near future. Our past borrowing is already catching up to us. Illinois would have had an extra $1.6 billion in available revenues this year if not for the debt service costs of previous years’ borrowing.”

The Institute urges lawmakers to face up to the unsustainable structural overspending that is driving the deficits year after year. The Institute’s Budget Solutions 2011 alternative budget showed how Illinois could balance the FY2011 budget, make the pension payment, and have money left over to begin paying down past-due debt—all without a tax increase or borrowing. Had Governor Quinn followed that roadmap, the Institute argues, Illinois would be in far better shape today. Instead, Governor Quinn has put his focus on borrowing and tax hikes in order to avoid taking on the public employee unions, Medicaid reforms, and other reforms offered by the Institute and others.

“It’s worth remembering that Governor Quinn only found one program—out of thousands—to veto outright when he signed this year’s spending bill in July. Had he taken a closer look at structural spending reforms and not agreed to politically motivated “no layoff and closure” deals with public employee unions, we could be on the path back to recovery instead of being stuck in ever-mounting debt,” noted Tillman.

Governor Quinn wants to pair the unprecedented borrowing with tax hikes on those who can least afford it. Under one revenue plan calling for a 66 percent income tax hike, a firefighter and a preschool teacher with two kids earning a combined $80,000 would have to pay $1,440 more in state taxes. This is more than double the expected savings from the federal tax cuts recently signed by President Obama. Struggling families shouldn’t have to bear the brunt of the state’s ill-advised spend-and-borrow habits.

The Illinois Policy Institute recently released a study, How to Lose Jobs and Alienate People, providing statewide and county-by-county income and job loss estimates associated with plans to increase the state income tax. The study, along with a tax calculator to see how the tax increase would impact individual taxpayers, is available at What You Need to Know: Tax Hike Research and Resources.

Quite literally Illinois is insolvent and Governor Quinn thinks borrowing another $15 billion will help.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com

Used with permission. All rights reserved

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: