Stop Spending, Stupid

Deficits and balanced budgets are political buzzwords. These terms are score-keeping functions, simple arithmetic calculations. They are outcomes that result from actions. They are not causes. Politicians never talk about causes — their spending.

From Monty Pelerin’s World

The Welfare State grows and grows and grows until it

The Welfare State grows and grows and grows until it  “runs out of other people’s money.” Then it collapses.

“runs out of other people’s money.” Then it collapses.

To understand what is happening around the world, refer back to the previous two statements.

Deficits and balanced budgets are political buzzwords. These terms are score-keeping functions, simple arithmetic calculations. They are outcomes that result from actions. They are not causes. Politicians never talk about causes — their spending.

Spending is an overt act. It is a decision made by someone or some group of people. It is that action that must be addressed. There is nothing nebulous about spending, however talking about spending does not provide political cover. Hence deficits, rather than the cause of deficits, are discussed. Doing so muddles the discussion and keeps the orientation off the real cause — spending. STOP SPENDING, STUPID!

As we enter the third year of Obamanomics, the deficit is projected to be larger than the first two years, each of which were multiples of the highest deficits ever seen in this country or the world. The fools in Washington dance around arguing over cutting a few billion dollars here or there and cannot even accomplish this simple task.

What a sad joke! The amounts that both parties ought to be arguing over is TRILLIONS, not billions. Instead, they can’t find or agree upon a cut of 1% of spending. How many families in this country can understand this behavior? They know how to cut 1%. Some have been forced to cut 20% or more to get through these tough times.

Unless the politicians take actions in the range of $500 Billion in spending cuts (or more), the Fed will continue to “print money” to pay for SPENDING that cannot be covered by tax revenues or normal market borrowing. We will end up in a hyperinflationary DEPRESSION.

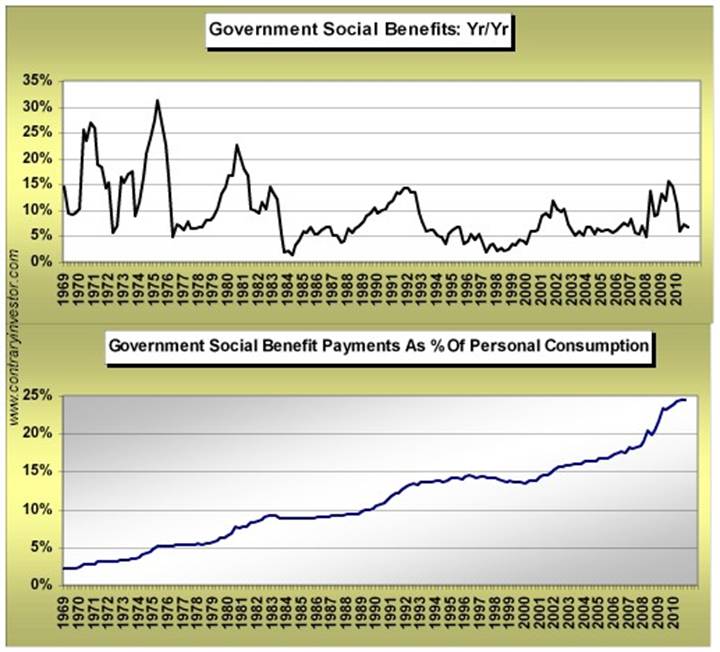

To illustrate the welfare state and its effect on spending, look at the growth in social benefits. The chart below shows the year-over-year percentage growth and the growth as a percentage of Personal Consumption. (Hat Tip to EBW for chart)

Since 1969 there has never been a y/y decline in the level of these benefits. Furthermore, these benefits have grown from about 3% of Personal Consumption to a current rate of 25%. Even when recessions end, the absolute value of these benefits continues to increase. For politicians who play Santa Claus every day is Christmas.

We and many other countries around the world have reached Margaret Thatcher’s famous warning point:

The trouble with Socialism is, sooner or later you run out of other people’s money.

When she stated this truth, Lady Thatcher probably had no idea that  governments would bankrupt their countries before admitting the welfare state was impossible. Arguably, the “out of other people’s money” point should have been reached 20 or so years ago. Had these programs been properly funded via taxation, politicians could not have gotten this far. The welfare state would have ended when voters refused to accept the tax levels necessary to continue government expansion.

governments would bankrupt their countries before admitting the welfare state was impossible. Arguably, the “out of other people’s money” point should have been reached 20 or so years ago. Had these programs been properly funded via taxation, politicians could not have gotten this far. The welfare state would have ended when voters refused to accept the tax levels necessary to continue government expansion.

Instead, the game has been extended a couple of decades via the use of extraordinary levels of debt, levels which are impossible to ever pay off. As markets refuse to accept new debt, our government has adopted “money printing” called Quantitative Easing to extend the sham even further.

In a few words, politicians have willfully bankrupted the country for their own political self-interests.

We are on the verge of bankruptcy, yet governments will not admit this fact. The Ponzi Scheme continues. It is a last gasp to try and prop up dying countries with more debt and inflation. It will not work because markets will finally step in with the final words: NO MORE!

It feels like we are getting close to that point.

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: