A $15-Trillion Problem: U.S. Debt To GDP at 98.9% and Rising

When the debt-to-GDP ratio of a country exceeds 90%, much less 100%, the drag on economic growth begins to rise sharply. This is one of the main problems facing many of the smaller Euro-zone countries today: They are carrying so much debt that they do not have the ability to “grow” their way out of their debt problems. The US has now also reached the level at which our total indebtedness is robbing economic growth.

By Lance Roberts of Streettalk Live at EconMatters

Very quietly the amount of total public debt currently outstanding exceeded $15 Trillion Dollars. While that may or may not surprise some of you, it is an issue that we have been watching sneak up on us. As the “Super Committee” approaches their deadline for finding $1.2 Trillion in spending cuts over the next 10 years, or just $120 Billion in cuts annually, this becomes an even more pressing and important issue for the economy and the markets. Don’t forget that the 20% selloff this past summer was sparked by the political warfare of raising the debt ceiling. That war could be set to rise again.

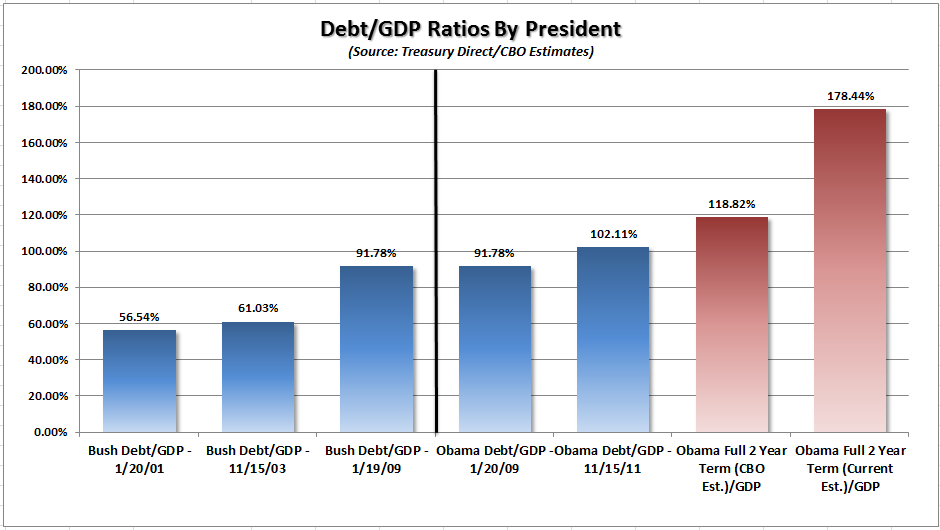

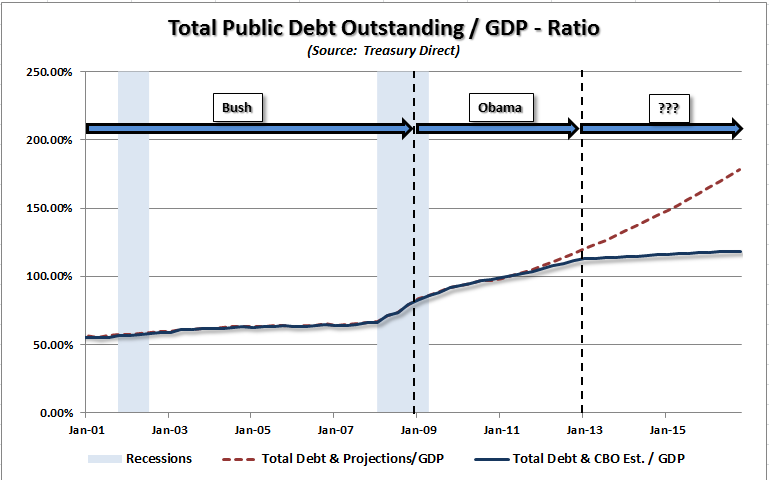

We have discussed this issue in the past but did some deeper work on the issue to create projections based on the current rate of debt growth as well as comparing it to the Congressional Budget Office estimates. In the chart above we have taken the amount of total public debt outstanding, which is debt held by the public plus intragovernmental holdings, from when President Bush entered office on January 20, 2001 until November 15, 2011.

We have then extrapolated the increase in debt based on the average rate of increase of the debt under the current administration to the end of President Obama’s potential second term ending January 19, 2017. This estimation is shown by the dotted red line. The blue line is the current level of debt with the Congressional Budget Office estimates for the same time period. Gross Domestic Product has been plotted as well and assumes a 2.5% annual growth rate for the years 2012-2017.

There are three important take aways from this chart. First, the rate of growth in debt has ramped up, not surprisingly, due to the onset of the second recession and financial crisis that began under the Bush administration. Poor policy choices to solve the financial crisis from bailouts to backstops to direct financial support have caused total public debt outstanding to mushroom.

Secondly, while the CBO estimates a leveling off of debt growth beginning roughly today, the current run rate of debt growth will begin to accelerate if some measure of fiscal stabilization is not enacted. (Side Note: The CBO projections since 2000 have been woefully short of reality.)

Lastly, this analysis assumes that there will not be another recession or economic slowdown in the next four years, which is hardly realistic. If a recession or economic slowdown occurs, these estimations rise sharply.

Which brings us to the main point. When the debt-to-GDP ratio of a country exceeds 90%, much less 100%, the drag on economic growth begins to rise sharply. This is one of the main problems facing many of the smaller Euro-zone countries today: They are carrying so much debt that they do not have the ability to “grow” their way out of their debt problems. The US has now also reached the level at which our total indebtedness is robbing economic growth.

However, the situation is must worse than even these charts show, as we are only discussing the total public debt outstanding, which is most commonly focused on by the government, media and mainstream analysts. The government has much more indebtedness that is considered “off balance sheet” such as Social Security, Medicaid, Medicare, Fannie Mae, Freddie Mac and Student Loans which we only hope won’t be a constituent to the next financial crisis lurking in the shadows.

As you can see, at the current run rate of debt growth, the US will be roughly $19 Trillion in debt by the time President Obama ends his first term and will be pushing $30 Trillion in debt by the end of his second term, should he be re-elected.

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: