Why we hate our government – stupid stuff from D.C.

We continue to see lunacy from congress which really amounts to feeble attempts to buy votes and stay in power while bankrupting future generations. Is there any wonder why congress’ approval ratings are at historic lows? Why do we keep sending the same stupid people back?

Consider these gems from Bruce Kasting:

Out of D.C.

The Congressional Budget Office (CBO) is obligated to review and “score” the financial consequences of any proposed legislation. It came out with a report on H.R. 4105. The title page of the Bill:

This legislation is about tariffs on China. The CBO concluded that the US Treasury will collect $160 billion over the next ten years if the law is passed. That may sound good to some; I see it as a disaster in the making. If H.R. 4105 passes, it will cost the country Trillions. The history books say that is so.

H.R. 4105 “Applies the duty provisions of the Tariff Act of 1930.” The  1930 legislation that H.R. 4105 is relying on has a different name in the history books. It is called the Smoot-Hawley legislation. It was the dumbest legislation that could have been passed. It insured that America would remain stuck in a depression for another four years.

1930 legislation that H.R. 4105 is relying on has a different name in the history books. It is called the Smoot-Hawley legislation. It was the dumbest legislation that could have been passed. It insured that America would remain stuck in a depression for another four years.

Smoot-Hawley worked as intended. From 1930 to 1934 imports fell by 65%. But damn near every trading partner, including England and Canada, retaliated by putting up their own tariffs. The depression spun around the globe as a result.

This time around will be no different. China will retaliate. Too bad the guys in D.C. don’t read history books.

The Congressional Progressive Caucus (CPC) decided to try to get Edward DeMarco, the Acting Director of FHFA fired:

The CPC has a point. Edward DeMarco is preventing Fannie and Freddie (F/F) from intering into massive write-downs of mortgages. If it were not for DeMarco, Obama would have done this a year ago.

Fannie and Freddie are sitting on (at least) three million underwater mortgages. Assuming the average size is $250k, and being under water by 30%, the cost of the write-downs would be $250 billion. That’s massive. But we spent $900b on the banks, the Iraq – Afghanistan wars have cost $1.5 Trillion, spending of Social Security will top $700B this year. The one time charge on ~60% of all underwater mortgages is not so big compared to those other numbers.

But where is the “fairness” in this proposal? The $250b is just more borrowed money. This plan passes the buck to the next generation when the debt comes due. What about the 40% who don’t have a mortgage with F/F? What about renters? Have they no rights at all?

The CPC will fail. DeMarco is sticking around until December. But if Obama wins big, and the Senate turns a deeper Blue, then DeMarco will be sacked. A “more friendly” Director of the FHFA will be installed.

This is an emotive topic. I’m interested in your thoughts. So are the “watchers” in D.C.

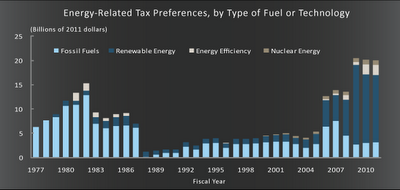

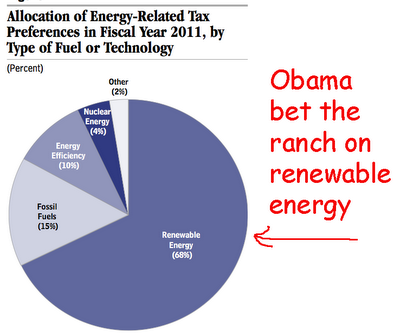

These charts shows where the $24B of federal subsidies to energy projects went in 2011 and comparisons over the past 35 years:

With his focus on alternative energy,Obama has ramped this number up to levels not seen before.

This strategy is a payoff to environmentalists. Obama will tout his spending record this fall. This is a “positive” message; and will probably get him votes.

The flip side is that many of the alternative energy investments are connected to characters that are having swell parties to raise money for O. Think Solyndra.

When Obama does play the “I’m green” card, the Republican PACs will have a field day. The ads won’t stop. We might see the “ugliest” election in history.

- Bruce Krasting

- Westchester, NY, United States

- I worked on Wall Street for twenty five years. This blog is my take on the financial issues of the day. I was an FX trader during the early days of the ‘snake’ and the EMS. Derivatives on currencies were new then. I was part of that. That was with Citi. Later I worked for Drexel and got to understand a bit about balance sheet structure and corporate bonds from Mike Milken. I was involved with a Macro hedge fund later. That worked out all right, but it is not an easy road. There was one tough week and I thought, “Maybe I should do something else for a year or two.” That was fifteen years ago. I love the markets. How they weave together. For twenty five years I woke up thinking, “What am I going to do today to make some money in the market”. I don’t do that any longer. But I miss it.

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: