Bernanke – ‘The Fed never makes mistakes’

Bernanke never acknowledged that the Fed contributed to the mess of 2008. If Ben wasn’t flat out lying, his head is buried very deeply in the sand.

By Bruce Kasting

Everyone makes mistakes. The best thing one can do is face up to the facts and acknowledge the error; fix the problem to the extent possible and do what is necessary to avoid repeating the mistake. Ben Bernanke’s inability to admit his (and his predecessor’s) mistakes condemns the Fed to repeat the sins of the past.

In this week’s lecture tour at George Washington U, Bernanke spoke to the students about the causes of the economic collapse of 2008. In his presentation, he identified most of the bad actors and the mistakes that those institutions made. He pointed his finger at:

-Fannie Mae and Freddie Mac

-The big banks and Wall Street wire houses

-Mortgage brokers

-AIG

He blamed:

-Sub Prime mortgages

-Excessive leverage

-Banks’ failure to adequately monitor and manage risks

-Excessive reliance on short‐term funding

-Increased use of exotic financial instruments that concentrated risk

Bernanke never acknowledged that the Fed contributed to the mess of 2008. If Ben wasn’t flat out lying, his head is buried very deeply in the sand.

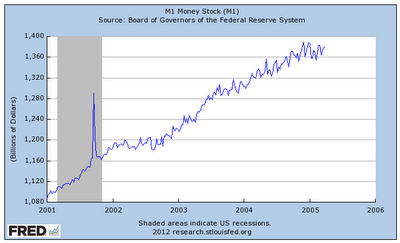

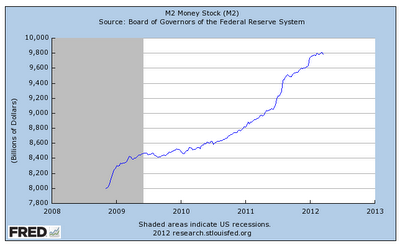

In response to the recession of 2001 the Fed allowed money supply to increase by 30% in 4 years:

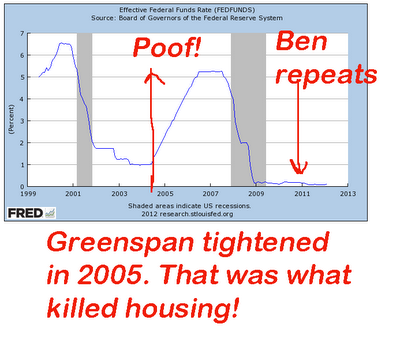

The Fed also manipulated interest rates. It drove short-tem rates (Federal Funds) to 1% in 2004.

When Greenspan tried to normalize interest rates in 2005 he was forced to raise the Fed Funds rate 13 times. This sharp increase was a significant factor in blowing the top off of the real estate market. Greenspan’s Fed contributed to the housing bubble. The Fed’s tightening brought on the bust that it helped create.

So where are we today on the critical issues that brought about the collapse of 2008?

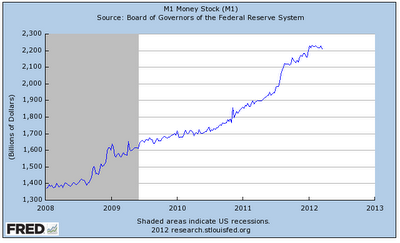

Money supply is zooming:

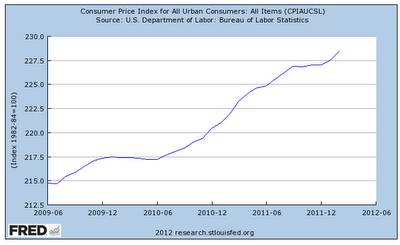

Inflation is chugging along:

Interest rates are pegged at zero:

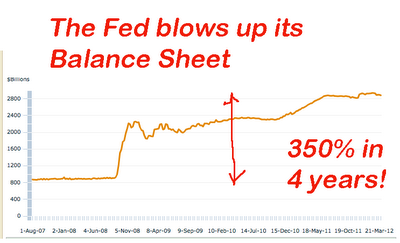

The Fed’s balance sheet is bloated:

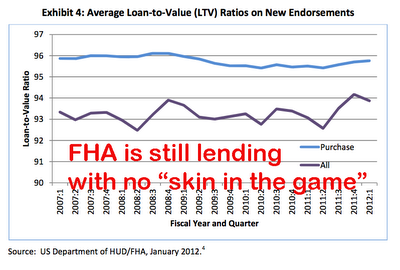

The government is still making junk mortgages; FHFA is guaranteeing loans at 97.5% of value.

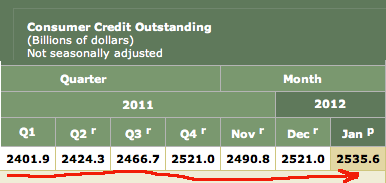

Consumers are borrowing more. Debt has grown 6% in the past year, three times the rate of growth in the economy.

Student loan balances have been exploding. They passed the Trillion mark this week:

The savings rate is the lowest it’s been since the crisis. Who would want to save money when the return on savings is negative?

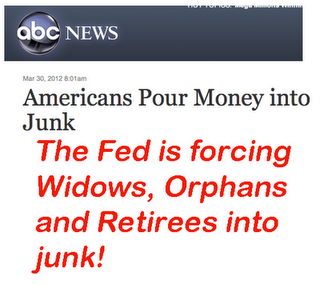

Junk bonds (and other forms of exotic debt) are back in style, and investors are lapping up the swill up.

Funny money credit is back. This outfit is lending money to all comers. I love it when the lady says, “Yes it is expensive”. (11 second video)

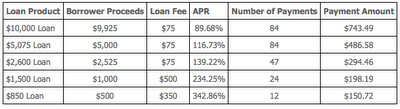

It’s not just expensive money, It’s crazy. Consider this chart of pricing:

If you want $10,000, the cost will be $52,343 in interest. If you only need a quick $500, these nice folks will give to you, but the cost will be $1800 or 340%%.

For the Chairman of the Fed to stand before all those GWU students and avoid accepting a share of the responsibility for what happened in 2008 is a gross re-write of history. That he does not see that he is making the same mistakes that the Fed made in every prior economic cycle is sad. The audience should have booed him. I am.

- Bruce Krasting

- Westchester, NY, United States

- I worked on Wall Street for twenty five years. This blog is my take on the financial issues of the day. I was an FX trader during the early days of the ‘snake’ and the EMS. Derivatives on currencies were new then. I was part of that. That was with Citi. Later I worked for Drexel and got to understand a bit about balance sheet structure and corporate bonds from Mike Milken. I was involved with a Macro hedge fund later. That worked out all right, but it is not an easy road. There was one tough week and I thought, “Maybe I should do something else for a year or two.” That was fifteen years ago. I love the markets. How they weave together. For twenty five years I woke up thinking, “What am I going to do today to make some money in the market”. I don’t do that any longer. But I miss it. View my complete profile

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: