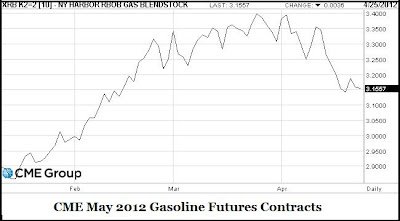

Gasoline-Futures Prices Tumble Due to Increased Oil Supply

Helping to spur the downturn is the reversal of a pipeline’s flow that will give refiners in the Gulf Coast region greater access to crude, the basic feedstock for gasoline.

By Mark J. Perry

Well now those greedy, market-destabilizing, market-manipulating speculators have changed course, and they’re now driving gasoline futures prices down, see chart above from the CME. From today’s WSJ:

“U.S. gasoline-futures prices have dropped 16 cents a gallon over the past eight trading days, as more U.S. crude becomes available for refining into gasoline and fears about a shortage of refining capacity fade.

Helping to spur the downturn is the reversal of a pipeline’s flow that will give refiners in the Gulf Coast region greater access to crude, the basic feedstock for gasoline. North Sea Brent crude, the European benchmark which holds sway over gasoline prices, already has fallen by more than $7 a barrel this month, partly on this development.”

MP: In other words, the price of gasoline is actually being determined by market forces, specifically an increase in the supply of oil, and not by speculators.

Dr. Mark J. Perry is a professor of economics and finance in the School of Management at the Flint campus of the University of Michigan. Perry holds two graduate degrees in economics (M.A. and Ph.D.) from George Mason University near Washington, D.C. In addition, he holds an MBA degree in finance from the Curtis L. Carlson School of Management at the University of Minnesota. He blogs at Carpe Diem.

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: