UK Back in Recession, Did it Really Ever Leave? Disappointing Details; Five Reasons the UK Recession Will Get Much Worse

If you thought the euro would help Europe, you thought wrong. The Euro made a disaster in Spain, Portugal, Ireland, Greece, and Italy. It’s time to abandon that failed idea.

By Mike “Mish” Shedlock

It is amusing to watch economists toss around ridiculous terms like “technical recession” to justify their poor forecasts. The entire eurozone is now in recession and the UK was sure to follow because so much of its trade is with the eurozone. This was easy to predict, yet few did.

The Mail Online reports We ARE back in recession: Economy suffers double dip as GDP figures fall for second quarter in a row

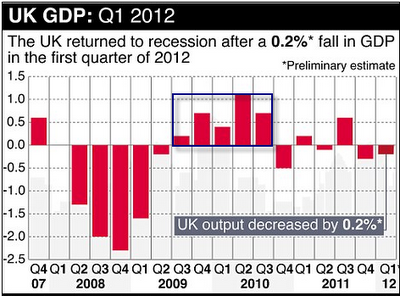

- Official figures today showed the economy shrank by 0.2 per cent in the first quarter of 2012

- It follows a fall of 0.3 per cent in the final quarter of 2011

- Cameron: ‘I do not seek to explain away the figures’

Britain has suffered its first double-dip recession since the 1970s after a surprise contraction in the first three months of the year.

Official figures today showed the economy shrank by 0.2 per cent in the first quarter of 2012 having declined by 0.3 per cent in the final quarter of 2011.

It marked the first double-dip since 1975 and was a bitter blow to Chancellor George Osborne in the wake of last month’s ‘omnishambles’ Budget.

The decline in gross domestic product (GDP) was driven by the biggest fall in construction output for three years, while the manufacturing sector failed to return to growth, the Office for National Statistics (ONS) said.

Andrew Smith, chief economist at KPMG, said: ‘It’s official, we’re in a double-dip.

‘But worse, output remains broadly unchanged from its level in the third quarter of 2010 and, four years on from its pre-recession peak is still some 4 per cent down – making this slump longer than the 1930s Depression.

UK GDP In Perspective

The UK had five consecutive quarters of growth so I suppose one can make a claim the recession ended. However, look at how feeble that growth has been. Only one quarter exceeded 1% and then just barely.

Moreover, for the last six consecutive quarters, there has not been two consecutive quarters of growth.

I suggest the UK slid back into recession during the 4th quarter of 2010.

Disappointing Details

It’s not just the headline numbers that are anemic, the details are also very poor. Via Email from Barclays …

As expected, construction output declined over the quarter. However, the ONS has made some revisions to the weak January and February data, and assumed some further revisions and a strong March outturn in arriving at the Q1 estimate, so that the estimated 3.0% q/q decline in construction output was less than half the fall we had expected. As a result, construction’s -0.2pp contribution to GDP growth was a lot less significant than we had anticipated.

Rather, much of the downside news came on the services side, where February’s Index of Services, published alongside the GDP data, disappointed to the downside, and January’s estimate was also revised down. Much of the weakness was concentrated in business services and finance, which accounts for almost 40% of total services output, and where activity declined by 0.1% q/q. As a result, overall services output grew by just 0.1% q/q in Q1, and the downside news on services more than offset the upside surprise on construction.

Like the MPC, we had thought that the weakness in the official construction data looked somewhat overdone, and had been prepared to look through downside news from this source. However, the disappointing outturn in services suggests that the economy’s underlying growth momentum may be somewhat weaker than previously thought.

The weak GDP outturn, combined with more persistent than expected inflation, highlights the MPC’s ongoing policy headache. April’s minutes showed the committee increasingly focused on inflation and minded to look through weak official activity data, which it expected to be driven mainly by somewhat dubious construction data. Further QE in May seemed unlikely. The configuration of today’s outturn, more than the headline number, may give the committee reason to reassess. We still expect no further QE in May, but this is now a less certain call; and even if QE is not extended then a continued stagnation in demand could yet lead the MPC to act later in the year.

Wishful Thinking

Barclays thinks the UK will “narrowly avoid further GDP contraction in Q2“.

I don’t. Why should it?

Five Reasons the UK Recession Will Get Much Worse

- The eurozone is now an economic disaster, credit stress has returned to Spain and Italy

- The ECB abandoned the LTRO and is in the midst of huge infighting

- UK services took a huge hit and that trend will strengthen

- The Eurozone is the UK’s largest trading partner and there is no reason for UK exports to the eurozone to rise. In fact, UK exports to the Eurozone, just may collapse.

- The better than expected (but still feeble construction numbers) will likely disappoint to the downside soon enough, if not immediately.

If you thought the euro would help Europe, you thought wrong. The Euro made a disaster in Spain, Portugal, Ireland, Greece, and Italy. It’s time to abandon that failed idea.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: