States That Have Recovered Jobs the Fastest Have Booming Energy Sectors

Energy is responsible for these states’ job recoveries “to a very large degree,” says Jim Diffley, senior director of U.S. regional services at IHS Global Insight. “In North Dakota and Alaska, the energy sector is predominately very much the single most important factor.”

By Mark J. Perry at Carpe Diem

“North Dakota, Alaska, Texas, and Louisiana may not seem to have much in common geographically or culturally, but they all are boosted by a booming oil industry.

Energy is responsible for these states’ job recoveries “to a very large degree,” says Jim Diffley, senior director of U.S. regional services at IHS Global Insight. “In North Dakota and Alaska, the energy sector is predominately very much the single most important factor.”

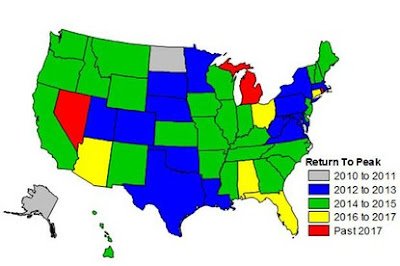

Meanwhile, states at the less fortunate end of the spectrum tend to have their own commonalities: continuing problems in their housing markets, meaning depressed construction employment. IHS’s analysis predicts that states in the West and Southeast will largely have to wait until 2014 or later before their jobs figures recover, with some states, like Arizona, Florida, and Nevada, having to wait until at least 2016.

According to the analysis, Nevada, Michigan, and Rhode Island may have the longest to wait before recovery, with their returns to their former job levels expected after 2017.”

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: