Shale Boom Will Create 1.5M New Jobs by 2035 and Generate $1.5T in Tax and Royalty Revenue – someone tell Obama

Drill, drill, drill = investment, investment, investment = jobs, jobs, jobs = government revenue, revenue, revenue = win, win, win.

By Mark J. Perry at Carpe Diem

From the IHS study released this week titled “The Economic and Employment Contributions of Unconventional Gas Development in State Economies”:

“Unconventional gas activity is having a dramatic impact on employment and economic growth across the U.S. lower 48 states, in terms of jobs and its contribution to gross state product (GSP) and, by extension, U.S. gross domestic product (GDP). This reflects the significant capital intensity required to develop unconventional gas resources, the ability to source inputs from a coast-to-coast network of suppliers and professional services around the United States, and the high quality of the jobs created by this activity.

Unconventional gas is expected to lead future growth in U.S. natural gas productive capacity. By 2015, the share of U.S. natural gas produced from unconventional sources will increase to 67% and, by 2035, will reach 79%. Increased unconventional gas activity will contribute to capital investment, job opportunities, economic growth, government revenue, and lower prices across the country including:

• Nearly $3.2 trillion in investments in the development of unconventional gas are expected to fuel the increase in production between 2010 and 2035.

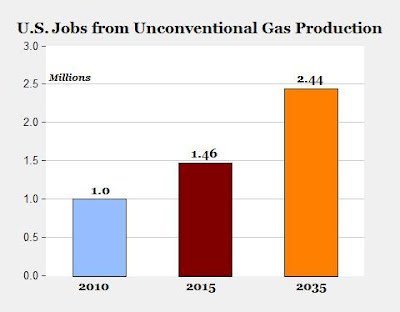

• In 2010, unconventional gas activity supported 1 million jobs; this will grow to nearly 1.5 million jobs in 2015 and to over 2.4 million jobs in 2035 (see chart above).

• By 2015, unconventional gas activities will contribute nearly $50 billion in federal, state and local government tax and federal royalty revenue; between 2010 and 2035, continued development of unconventional gas will generate a cumulative total of nearly $1.5 trillion in federal, state, and local tax and royalty revenue.

These economic contributions will be largely driven by activity in the 20 producing states with both new well completion and production or existing production. However, the 28 non-producing states that do not include projected unconventional gas development will still contribute nearly one in every five jobs to the overall economy.”

Bottom Line: Drill, drill, drill = investment, investment, investment = jobs, jobs, jobs = government revenue, revenue, revenue = win, win, win.

Dr. Mark J. Perry is a professor of economics and finance in the School of Management at the Flint campus of the University of Michigan. Perry holds two graduate degrees in economics (M.A. and Ph.D.) from George Mason University near Washington, D.C. In addition, he holds an MBA degree in finance from the Curtis L. Carlson School of Management at the University of Minnesota. In addition to a faculty appointment at the University of Michigan-Flint, Perry is also a visiting scholar at The American Enterprise Institute in Washington, D.C.

Editor’s note:

Dramatic differences in the housing market in Detroit and in North Dakota reflect the tax and spend pro union leftist philosophy of Obama and leftists which has been practiced in Detroit for decades and the free enterprise economy of north Dakota.

Also from Mark J. Perry:

The 4-bedroom, 2-bath Detroit home above (pictured above on the left) is going for $2,900, the same as the 3-bedroom home near Williston, North Dakota (on the right).

The difference? $2,900 is the list price to buy the home in Detroit, and $2,900 is the monthly rent for the home in North Dakota near the oil patch.

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: