This ain’t about Greece any more folks

I talked with a Swiss banker from Geneva today. The conversation went like this:

BK – Are you guys still seeing boatloads of money coming in from outside the country?

Geneva – Yes, the money is still coming. In the past two weeks the Swiss National Bank (SNB) was forced to intervene in support of the 1.20 peg. The amounts were big, over EUR 20 billion was purchased.

BK – What is going on at the borders? Is money still coming in by car?

Geneva – Yes. The border guards can’t search every car. The latest development is that the Border Guards are now searching some of the cars that are leaving Switzerland.

BK – Why would border guards stop cars that are leaving Switzerland? What are they looking for?

Geneva – Mules. Professionals who smuggle money. It is very easy for a Swiss to go to a bank and withdraw a large amount of paper money. The mules bring the cash over the border to French and Italians who want Swiss Francs. The Mules also bring Euros into Germany for those who have private accounts in Switzerland who want cash to spend.

Geneva – Mules. Professionals who smuggle money. It is very easy for a Swiss to go to a bank and withdraw a large amount of paper money. The mules bring the cash over the border to French and Italians who want Swiss Francs. The Mules also bring Euros into Germany for those who have private accounts in Switzerland who want cash to spend.

BK – Is the paper money coming in and out of the country being done in large amounts?

Geneva – Yes this is big, but compared to the bank transfers that go on, or the amounts held in Euro Swiss (rolling FX positions) is much much larger.

BK – Where is the money coming from?

Geneva – From all over the globe, but not the USA. If an American comes in, we just show them the door.

BK – Where does the most money come from, France or Italy?

Geneva – In the past few weeks we have seen more inflows from Russians  than any other country.

than any other country.

BK – Russians? That’s surprising. What do you attribute this to?

Geneva – It’s politics and economics together. People are afraid.

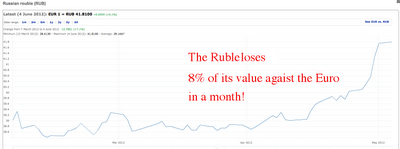

The following looks at the performance of the Russian Ruble versus the dollar the past few months. Not pretty at all:

This ain’t about Greece any more folks.

- Bruce Krasting

- Westchester, NY, United States

- I worked on Wall Street for twenty five years. This blog is my take on the financial issues of the day. I was an FX trader during the early days of the ‘snake’ and the EMS. Derivatives on currencies were new then. I was part of that. That was with Citi. Later I worked for Drexel and got to understand a bit about balance sheet structure and corporate bonds from Mike Milken. I was involved with a Macro hedge fund later. That worked out all right, but it is not an easy road. There was one tough week and I thought, “Maybe I should do something else for a year or two.” That was fifteen years ago. I love the markets. How they weave together. For twenty five years I woke up thinking, “What am I going to do today to make some money in the market”. I don’t do that any longer. But I miss it. View my complete profile

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: