Dumb & Dumber – Inflated GPA and Tuition

Perhaps students find it easier to accept rising tuition, higher textbook prices, and $25,000 in average student loan debt if they at least graduate with mostly As and a GPA above 3.0? Even if they can’t find a job, they can take pride in having “earned” an inflated GPA?

By Mark J. Perry at Carpe Diem

That’s what was suggested in a recent CD post about grade inflation at the University of Minnesota, based on the Star Tribune article “At U, concern grows that ‘A’ stands for average.” In the article, a Minnesota undergraduate student explained the rising GPA trend by saying “We live in a grade-inflated world.” A University of Minnesota anthropology professor quoted in the article suspects that attitude among students can be traced to rising college tuition, i.e. today’s “tuition-inflated world.” The professor commented “They’re paying for it, and they worked really hard, and they put in time, and therefore they think they should get a good grade.”

I concluded in the post that: The connections among “grade inflation, “tuition inflation,” “college textbook inflation,” and exponentially rising student loan debt are important. Perhaps students find it easier to accept rising tuition, higher textbook prices, and $25,000 in average student loan debt if they at least graduate with mostly As and a GPA above 3.0? Even if they can’t find a job, they can take pride in having “earned” an inflated GPA?

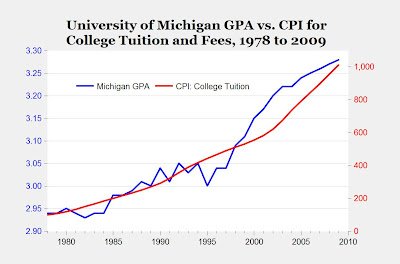

The chart above confirms the historical relationship between rising college tuition (based on the CPI for college tuition and fees) and the rising GPA at the University of Michigan, where grade inflation since the 1970s closely reflects the national trend (data here). With the caveat that correlation doesn’t prove causation, there does appear to be a statistical relationship (association) between college tuition and average college GPAs, which have both risen together over time in a similar pattern.

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: