The Debt Death Spiral

Where this funding will come from is the $64 Trillion question. Very likely it will be created out of thin air by Central Banks, exactly as they have done for much of the last four years. Obviously there is a limit to how much money they can create before fiat currencies collapse.

By Monty Pelerin

In the category of things to keep you up at night, consider the sovereign debt requirements  in the next several years.

in the next several years.

According to Chris Puplava:

Nearly 50% of the total outstanding debt of the world’s top 10 debtor nations needs to be rolled over by the end of 2015.

This amount is staggering! For the top ten debtor nations it totals $15 Trillion! That is approximately the entire size of US annual GDP and over 20% of annual world GDP.

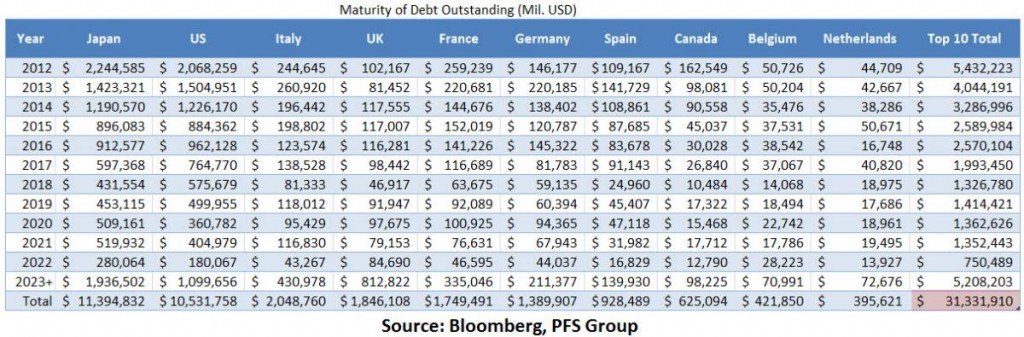

The following table shows the maturity schedule by major country:

The table only reflects only debt maturing. This amount would be difficult enough to finance, but these nations all run deficits which must be funded as well. With obvious deterioration in credit quality of these sovereigns, who will purchase this debt at today’s interest rates of near zero, at least in the US?

Mr. Puplava provides his expectation:

… global central banks will be monetizing debt in massive quantities between

now and 2015 because large portions of debt will be maturing in just the next two and a half years. For example, both the US and Japan will see one fifth of their entire debt outstanding mature just between now and the end of the year, with Canada seeing 26% of their total outstanding debt mature! The other members of the top 10 are only in a slightly better position with all but the UK to see double-digit debt rollovers of their total outstanding debt between now and 2015.

Continuing deficits add to these figures. The US will need to fund new debt resulting from projected deficits almost equal to its rollovers in the next three years. The total amount of debt issuance to meet both requirements totals over $8 Trillion dollars. Other countries in the above table run annual deficits which must also be added on to their rollover requirements. Proportionately, some are bigger than what is required in the US.

Where this funding will come from is the $64 Trillion question. Very likely it will be created out of thin air by Central Banks, exactly as they have done for much of the last four years. Obviously there is a limit to how much money they can create before fiat currencies collapse.

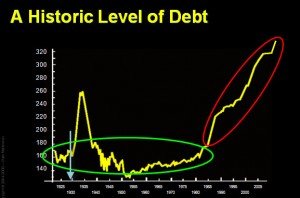

We are in the latter stages of the debt death spiral where debt and interest payments can  only be made by adding more debt. This process has a sure ending. Like the flush of a toilet, the spiral goes faster and faster until it finally ends.

only be made by adding more debt. This process has a sure ending. Like the flush of a toilet, the spiral goes faster and faster until it finally ends.

Mr. Puplava concludes:

There is just too much debt maturing over the next couple of years for capital markets to absorb and it is highly likely we will see global quantitative easing occur as central banks step in to be buyers of last resort to help suppress interest rates and keep debt servicing costs low.

If so, and I don’t see any other sources of funding possible, the question is when and how does this Ponzi scheme collapse? These debts cannot be funded without massive debasement of the currency — all currencies.

If so, and I don’t see any other sources of funding possible, the question is when and how does this Ponzi scheme collapse? These debts cannot be funded without massive debasement of the currency — all currencies.

Nothing has been done to stop this march to ruin by the political classes. Nothing will be done! When this ends will be determined not by politicians but by markets. Markets will eventually discipline politicians and all who trusted them.

“Got Gold?”

“Monty Pelerin” is a pseudonym derived from The Mont Pelerin Society. The writer has no connection with the Society (other than coincidence of philosophy). Nothing said by me should be considered to be representative of the views of the Mont Pelerin Society or any of its members. “Monty Pelerin” blogs at Monty Pelerin’s World

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: