Fed’s Inflation Cliff is Next

Hyperinflation or a brutal hike in interest rates — [could make] the present “fiscal cliff” look tame in comparison. – IBD

From IBD Editorials

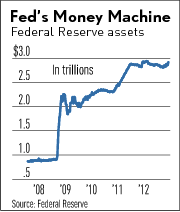

The Fed has added some $2 trillion to its balance sheet since the end of 2008  (putting it at about $2.9 trillion, see chart) as it creates new bank reserves to buy bonds.

(putting it at about $2.9 trillion, see chart) as it creates new bank reserves to buy bonds.

Its new program includes purchases of $45 billion in Treasurys and $40 billion in MBSs each month, which would boost its balance to $4 trillion by the end of 2014.

In the old days, this would lead to a burst of new lending and much more money in circulation. This time, the Fed has managed to avoid doing this — in essence, stuffing most of its new money into a very large mattress.

….

How long can this last? The economy continues to sputter four years into the Fed’s near-zero interest rate regime. Meanwhile, the U.S. government soaks up the global supply of credit with its insatiable borrowing.

FULL ARTICLE

Also please consider:

Our Government-Created Financial Crisis

Obama Wants Unlimited Power to Raise Debt Limit, Bankrupt America

Entitlements are a Bigger Cliff

Has Obama Already Bankrupted America?

The Federal Reserve Is Systematically Destroying Social Security And The Retirement Plans Of Millions Of Americans

19 Reasons Why The Federal Reserve Is At The Heart Of Our Economic Problems

Unmasking the Federal Reserve

How QE3 Will Make The Wealthy Even Wealthier While Causing Living Standards To Fall For The Rest Of Us

Do We Really Need To Audit The Federal Reserve?

10 Things That Every American Should Know About The Federal Reserve

The Giant Federal Reserve Scam That Most Americans Do Not Understand

5 New Lies That The Federal Reserve Is Telling The American People

Beck Explains Why the Federal Reserve Is a Complete ‘Scam’

25 Signs That Middle Class Families Have Been Targeted For Extinction

I’m Worried

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: