Why Should I Care About the U.S. Debt?

By the time today’s 6-year-olds are driving, the level of the U.S. debt will be teetering on 90 percent of the entire economy. Research shows that economies that reach this level suffer from long downturns in economic growth.

By Amy Payne at Heritage Foundation

You’re busy. So busy you barely have time to read these words. So why should you care about the U.S. debt? Does it affect your life?

Unfortunately, high government debt is having more of an impact on each of us than we realize. Heritage’s Romina Boccia explains that high levels of federal debt are linked to all of these problems for Americans:

Higher interest rates on mortgages, car loans, and other loans. For many people,  this means having to wait to buy a home. High interest rates on loans can prevent people from getting a loan to start a business, make home improvements, or further their education.

this means having to wait to buy a home. High interest rates on loans can prevent people from getting a loan to start a business, make home improvements, or further their education.

Higher inflation. We’ve already seen food prices rise over the past few years. Higher inflation hits the poor and middle class hardest, because hard-earned dollars don’t go as far. Food, clothing, and medical care all cost more. Seniors who are living on fixed incomes can see their savings dwindle. People who are in the middle class can start slipping toward the poverty level.

Keeping the economy down—and driving it down further. Deficit spending by the government is not separate from the economy; in fact, it drains money from private savings, which means fewer people are investing in the economy. In short, high debt kills jobs. It lowers wages and salaries as it drags the whole economy down.

>>> Join the thousands of Americans urging Congress to balance the budget NOW

Boccia notes that “Publicly held debt in the United States will exceed 76 percent of gross domestic product (GDP) in 2013, and chronic deficits are projected to push U.S. debt to 87 percent of the economy in 10 years.”

By the time today’s 6-year-olds are driving, the level of the U.S. debt will be teetering on 90 percent of the entire economy. Research shows that economies that reach this level suffer from long downturns in economic growth.

That’s the last thing we need—unemployment has already been stuck in neutral for the past four years, and our economic growth has been sluggish. The Congressional Budget Office has warned that “growing federal debt also would increase the probability of a sudden fiscal crisis” that would “probably have a very significant negative impact on the country.”

It’s difficult to imagine a nationwide strike in America that would ground all flights and shut down all services. Or an exchange of Molotov cocktails and tear gas between protesters and riot police. Or protesters torching banks, resulting in the deaths of innocent bystanders. That’s where Greece’s debt crisis took that country—eventually, Greece’s lawmakers had to start making the tough decisions and cutting back on spending. The cuts were painful, and the citizens revolted.

It’s difficult to imagine a nationwide strike in America that would ground all flights and shut down all services. Or an exchange of Molotov cocktails and tear gas between protesters and riot police. Or protesters torching banks, resulting in the deaths of innocent bystanders. That’s where Greece’s debt crisis took that country—eventually, Greece’s lawmakers had to start making the tough decisions and cutting back on spending. The cuts were painful, and the citizens revolted.

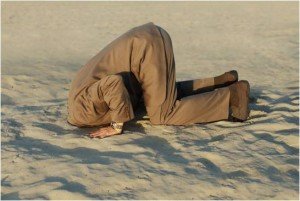

This is the track we are on. Right now, cutting spending and reforming entitlement programs in a gradual and predictable fashion may not be politically popular—but as Greece teaches us, waiting until a crisis forces lawmakers to make much more drastic policy changes can end badly—very badly. Our lawmakers should learn the lesson Europe is teaching us: Procrastinate on this massive debt at your own peril.

Boccia warns that “U.S. public debt is far too high at more than three-quarters the size of the economy—and growing federal spending, especially on entitlements, is quickly driving debt to damaging levels.” The solution is that “Congress and the President should take firm and immediate steps to balance the budget within 10 years, by cutting spending and reforming entitlements.”

Amy Payne is Assistant Director of Strategic Communications at The Heritage Foundation. In that capacity, Amy serves as Managing Editor of The Foundry, Heritage’s public policy news blog, as well as the “Morning Bell,” one of Washington’s most widely read and influential e-newsletters.

Also please consider:

Has Obama Already Bankrupted America?

Obama Has Stolen $5.3 Trillion From Our Children In Order To Make Himself Look Good

Debt quotes

Obama’s Achievement – Gov’t Has Become Gigantic Wealth-Transfer Machine

9/12 – the Manhattan attack that gave us Obama

Mark Levin: Obama is a Marxist

Debt Jumps More Than $1T for 5th Straight Fiscal Year

Fed’s holding of US debt up 452% under Obama

After the Sovereign Debt Crisis Comes the Deleveraging

Politicians as Economic Arsonists

Too Much Debt: Our Biggest Economic Problem

California and Illinois are living in Obama’s second term

Twenty-Nine Reasons to Be Angry And/Or Scared – Still

The Real End Game, We’re Coming To The End

Obama leads “Forward” to ruin and destruction

Not Worth a Continental

So you think we’re better off?

New report – Billion$ in Obama’s auto bailout went to rich unions

Spending and debt causing global slowdown

Fed’s holding of US debt up 452% under Obama

Beck Explains Why the Federal Reserve Is a Complete ‘Scam’

Obama’s real spending record

By Incentivizing Debt, We’ve Guaranteed Debt-Serfdom and Stagnation

CBO: spending binge endangers our children’s future

Dangers of Government Dependency – Econ 101

Sen. Dirksen Left Vs Right in 1964

CBO Agrees: Less debt, lower tax rates good for economy, jobs & growth

Leftists call for more of the same – spending and debt

Potential Victories for Individual Rights in 2012

Please Excuse My (Failed) President

Obama campaign panicking over bad economic news – “not a single idea” – Krauthammer

On Shills, Technocrats, Politicians and the Sinking Ship

Economy tanking under Obama

You lie! Krauthammer: Obama spending claim “unbelievable distortion of the truth”

Why Obama Failed

U.S. Set to Lead World Over Debt Cliff Into Recession

Rubio: “Do people back home fully understand”

Government has doubled since 2001 – Sen. Coburn

Obama railed against deficits until he became radical record breaking big spender

The other Obama on PAYGO

Obama’s $5 Trillion Moment

Paul Ryan: President’s failed policies causing record poverty

Gov. Mitch Daniels: Debt ‘Will Lead to National Ruin’

U.S. Student Debt To Reach $1.4 Trillion by 2020

34 Shocking Facts About U.S. Debt That Should Set America On Fire With Anger

King of debt

Return to Debt Mountain

15 Trillion Dollars In Debt, 45 Million Americans On Food Stamps And Zero Solutions On The Horizon

Obama warns Americans not to panic while he ruins the economy

What Do You Believe — Cash or Government Propaganda?

National debt really $24 TRILLION

THE FALLACY OF A RETURN TO NORMALCY

42% See U.S. Debt Default Somewhat Likely in Next 5 Years

New Obama Record – Debt Growth to Top Economic Growth for Decade

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: