Smoke And Mirrors Running Out — Depression to Follow

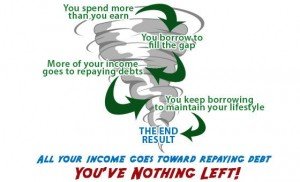

The government is in what is known as a debt death spiral. They must borrow money to repay prior debts. It is as if they are using their Visa Card to make an American Express payment. The rate of new debt additions dwarf any rate of growth the economy can possibly achieve. The end is certain, only its timing is unknown.

By Monty Pelerin

Those who believe the economy is recovering are ignorant of the facts. Other than the Great Depression no US recovery (and I don’t believe we are in a recovery) taken longer. Eventually it may take more than a decade like the 1930s. Or perhaps it will be like Japan which is in its third decade of “recovery.”

Politics and Economics

The truth is that our economy is spent, exhausted and filled with misallocations and distortions made much worse by government interventions. There is no recovery, nor will there be one until a massive purge (usually referred to as a depression) occurs. This event will result in bankruptcies that release scarce, misallocated physical capital from unproductive and unwanted areas to places where it is needed and can be utilized efficiently.

Rather than allow this pre-condition to an economic recovery and a growing, efficient economy, politicians want to prevent it. They use smoke, mirrors and propaganda (lies) to hide the reality of our sick economy. Their obfuscations continue, but the effective life is limited.

What politicians do to the country beyond their term in office means nothing to them. Their concern is only for themselves and the short-term that exists between elections. As a result they rob from the future to hide the true conditions of the present. Those still unborn will be paying for their criminal economic charade.

Economic Conditions

So how bad is the economy? Karl Denninger is among the more prolific as well as more incisive financial analysts on the web. His site is always worth reading, but a recent post is essential [Fed Z1: A SEVERE Storm Warning]. To impress upon you the seriousness of the situation and to encourage you to read his post, I quote some of his points (anything in red is my emphasis):

as well as more incisive financial analysts on the web. His site is always worth reading, but a recent post is essential [Fed Z1: A SEVERE Storm Warning]. To impress upon you the seriousness of the situation and to encourage you to read his post, I quote some of his points (anything in red is my emphasis):

… we’re doing the same thing that led to the 2008 blowup — we’ve learned exactly nothing. In real terms our GDP is in fact contracting by about $500 billion a quarter, after adjusting for debt expansion — that’s $2 trillion a year, more or less.

In terms of debt and inflation, Denninger determined that:

… we’re contracting in purchasing power adjusted for new debt at more than 10% over the last four quarters.

The debt to GDP ratio reached the highest in history just before the 2008 collapse. It remains in this record territory and is just as unsustainable now as it was in 2008:

… the absolute level of debt to GDP, however, refuses to go under 350%; it has now started rising again but is entirely coming from two sectors — business credit and the Federal Government.

Consumers reduced their debt levels, although probably not enough. They are still strapped with more debt than many can properly service. Consumption, as a result, has dampened as more income goes to debt service and less debt is added. That appears to be a condition that should prevail for several more years.

Remember, the announced reason for the loose Fed policy was to drive consumption. As Mish observed:

… this so-called “expansion” driven by ZIRP and deficits has a use-by date that has expired and we are now trying to evade the fact that the fish is well into the “stinks up the joint” stage.

Obviously, it has not worked.

Read Denninger’s article to view most of his observations in chart format.

Desperate Government

Although Denninger does not make this point, I believe it is a relevant one. Government continues to borrow and spend in an effort to hide the truly rotten condition of the economy. This action was begun under the guise of stimulating a recovery. It is obvious that it has not worked. It was obvious to some that it could never work.

Despite its obvious failure, theft from future generations continues. There are two main reasons for this, in my opinion:

- To hide from the people how desperate the economic situation truly is.

- To enable government to continue its current level of spending which cannot be funded via tax revenues or real market Treasury sales (certainly not at current interest rates; perhaps at no reasonable interest rate).

Government has exhausted its faux solutions. Nothing they do, except reduce spending, can help the economy. Reducing spending means another Great Depression and the exposure of the economic scam they have been running. Thus, spending will likely continue as will the Federal Reserve enabling, euphemistically called quantitative easing.

A Fly In The Ointment

There is a limit on how long the fraud continues. The government is in what is known as a debt death spiral. They must borrow money to repay prior debts. It is as if they are using their Visa Card to make an American Express payment. The rate of new debt additions dwarf any rate of growth the economy can possibly achieve. The end is certain, only its timing is unknown.

Once interest rates begin to rise, and they will, it is game over. Short-term Treasury interest rates are normally 3% with no inflation. In an inflationary environment, a premium for expected inflation is tacked on to that 3%.

Under today’s conditions, ST Treasuries could easily rise to 6 – 9%.  The low end of the range represents a rise in rates of more than 5.5%. If the debt outstanding, most of which is short-term, is $17 Trillion, that would been a rise in interest expense of close to a Trillion dollars annually. That would be added to deficits which are expected to be around a Trillion dollars per year. The high end of the range would produce a deficit in excess of $2.5 Trillion per year.

The low end of the range represents a rise in rates of more than 5.5%. If the debt outstanding, most of which is short-term, is $17 Trillion, that would been a rise in interest expense of close to a Trillion dollars annually. That would be added to deficits which are expected to be around a Trillion dollars per year. The high end of the range would produce a deficit in excess of $2.5 Trillion per year.

At the low end of the interest rate range, deficits would exceed more than 10% of GDP, putting us right up there with the sick European countries. At the high end, we would be like Greece without its glorious history and climate.

It gets worse than the above numbers convey. When interest rates rise, the economy will contract and probably severely. Then cries for more stimulus would be heard. An additional Trillion dollars or so would likely be added to the deficit, although many would want multiples of that. In either case, we become Greece on steroids.

Another Fly In The Ointment

There are those who say the US government cannot go broke because it has a printing press. They argue that the level of deficits don’t matter because the US can just print more money. Monetary fraud, which this is, also has a limit.

Only paper and ink limit the amount of currency the government can print. However, government does not control the value of the money which is determined by the public. Printing money depreciates the value of money (otherwise known as inflation). Market forces (economic actors) determine what this value is via supply and demand interaction.

Only paper and ink limit the amount of currency the government can print. However, government does not control the value of the money which is determined by the public. Printing money depreciates the value of money (otherwise known as inflation). Market forces (economic actors) determine what this value is via supply and demand interaction.

When money is expected to buy less tomorrow than it does today, people will spend it sooner. This drives inflation even higher. Ludwig von Mises described this end phase as a crack-up boom:

Credit expansion can bring about a temporary boom. But such a fictitious prosperity must end in a general depression of trade, a slump.

The boom produces impoverishment. But still more disastrous are its moral ravages. It makes people despondent and dispirited. The more optimistic they were under the illusory prosperity of the boom, the greater is their despair and their feeling of frustration.

Mises spent much of his life studying money, the business cycle and inflation. He correctly identified the choice that now stands before our political class (my emboldening added):

There is no means of avoiding the final collapse of a boom brought about by credit (debt) expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit (debt) expansion, or later as a final and total catastrophe of the currency system involved.

In the event of the total catastrophe, savings and fixed income  become worthless. The middle class of a country is wiped out in terms of wealth. Poverty abounds except at the top where those with large wealth and insider information are able to protect themselves and enhance their real wealth. Inflation does not destroy wealth; it merely redistributes it.

become worthless. The middle class of a country is wiped out in terms of wealth. Poverty abounds except at the top where those with large wealth and insider information are able to protect themselves and enhance their real wealth. Inflation does not destroy wealth; it merely redistributes it.

How Does It End?

Neither ending is attractive, but opportunities for one or the other have been squandered. Sadly, the decision as to which route is taken is in the hands of our criminal political class. Their behavior suggests that they will do whatever it takes to continue the charade. They want to maintain their scam for as long as they can..

If they are successful, a crack-up boom is coming. History shows this ending in most all countries in our condition.

“Monty Pelerin” is a pseudonym derived from The Mont Pelerin Society. The writer has no connection with the Society (other than coincidence of philosophy). Nothing said by me should be considered to be representative of the views of the Mont Pelerin Society or any of its members. “Monty Pelerin” blogs at Monty Pelerin’s World

Also please consider:

A Message from Lord Vader

Has Obama Already Bankrupted America?

Is The Fed Acting Like a Day Trader?

17 Reasons the $17 Trillion Debt Is Still a Big Deal

Government Zombie Policies and the Rationing of Retirement

9/12 – the Manhattan attack that gave us Obama

The Corruption of America

Obama Has Stolen $5.3 Trillion From Our Children In Order To Make Himself Look Good

Obama on debt in 2008

Debt quotes

Obama’s Achievement – Gov’t Has Become Gigantic Wealth-Transfer Machine

Obama sued banks to give subprime loans to Chicago’s African-Americans

A billion here a trillion there, soon you’re talking about real money

People who will vote for Obama still believe what he says

Obama Has Stolen $5.3 Trillion From Our Children In Order To Make Himself Look Good

Debt Now $16 TRILLION and Climbing Fast

Debt quotes

Mark Levin: Obama is a Marxist

Debt Jumps More Than $1T for 5th Straight Fiscal Year

Fed’s holding of US debt up 452% under Obama

After the Sovereign Debt Crisis Comes the Deleveraging

Politicians as Economic Arsonists

Too Much Debt: Our Biggest Economic Problem

California and Illinois are living in Obama’s second term

Twenty-Nine Reasons to Be Angry And/Or Scared – Still

The Real End Game, We’re Coming To The End

Obama leads “Forward” to ruin and destruction

Not Worth a Continental

So you think we’re better off?

New report – Billion$ in Obama’s auto bailout went to rich unions

Spending and debt causing global slowdown

Fed’s holding of US debt up 452% under Obama

Beck Explains Why the Federal Reserve Is a Complete ‘Scam’

Obama’s real spending record

By Incentivizing Debt, We’ve Guaranteed Debt-Serfdom and Stagnation

CBO: spending binge endangers our children’s future

Dangers of Government Dependency – Econ 101

Sen. Dirksen Left Vs Right in 1964

CBO Agrees: Less debt, lower tax rates good for economy, jobs & growth

Leftists call for more of the same – spending and debt

Potential Victories for Individual Rights in 2012

Please Excuse My (Failed) President

Obama campaign panicking over bad economic news – “not a single idea” – Krauthammer

On Shills, Technocrats, Politicians and the Sinking Ship

Economy tanking under Obama

You lie! Krauthammer: Obama spending claim “unbelievable distortion of the truth”

Why Obama Failed

U.S. Set to Lead World Over Debt Cliff Into Recession

Rubio: “Do people back home fully understand”

Government has doubled since 2001 – Sen. Coburn

Obama railed against deficits until he became radical record breaking big spender

The other Obama on PAYGO

Obama’s $5 Trillion Moment

Paul Ryan: President’s failed policies causing record poverty

Gov. Mitch Daniels: Debt ‘Will Lead to National Ruin’

U.S. Student Debt To Reach $1.4 Trillion by 2020

34 Shocking Facts About U.S. Debt That Should Set America On Fire With Anger

King of debt

Return to Debt Mountain

15 Trillion Dollars In Debt, 45 Million Americans On Food Stamps And Zero Solutions On The Horizon

Obama warns Americans not to panic while he ruins the economy

What Do You Believe — Cash or Government Propaganda?

National debt really $24 TRILLION

THE FALLACY OF A RETURN TO NORMALCY

42% See U.S. Debt Default Somewhat Likely in Next 5 Years

New Obama Record – Debt Growth to Top Economic Growth for Decade

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: