Factors that will Determine the Future

The US government is broke. It has debt and commitments which cannot possibly be honored. The US financial system is insolvent and likely will topple. The Wall Street – Washington nexus is corrupt and is attempting to cover up the extent of insolvency.

Monty Pelerin’s World

I am long overdue on this second of a series of articles on investing.

This article deals with the background conditions that will influence (likely dominate) the economic future. It is necessary to understand these in order to understand what is likely to occur, so I wanted to emphasize these prior to presenting a forecast.

These factors are entirely unique, at least for anyone living today. Pundits and forecasters using traditional economic measures and models are wasting their time and misleading themselves unless they incorporate these considerations into their thinking. These factors are so powerful that they will overwhelm the traditional economic model.

The media has not been very helpful in either presenting or understanding what has happened and the associated implications. The backdrop to the future is more ominous than reported. CNBC continues its pollyanaish reporting while other outlets either don’t understand or want to protect the political establishment.

If you have a financial advisor, it is important that he formalize the circumstances that will dominate our future.

Some Givens That Influence My Thinking

The following are factors that provide the backdrop for my pessimistic outlook:

Political Factors

- The US government is broke. It has debt and commitments which cannot possibly be honored.

- The US financial system is insolvent and likely will topple. The Wall Street – Washington nexus is corrupt and is attempting to cover up the extent of insolvency. The corruption must be excised.

- There will be no political solution to these problems. In all likelihood an economic collapse will occur before they are meaningfully addressed.

- Severe unrest in the US and in other countries where government reneges on its promises are likely.

- Such conditions often produce wars, either internal or external.

Economic Factors

- No economy can grow in the sense of creating jobs or per capita wealth increases once its non-productive (government) sector grows beyond some level. The US and much of the western world have passed that point.

- The productive capital base of this country was diminished via harmful regulations and taxes. Some of the capital was consumed while much fled to other parts of the world where it would be treated more favorably. This “government drag” continues to drive down living standards and drive out productive assets and citizens.

- All social welfare states around the world are insolvent and unable to honor their obligations. They all will default. These defaults are apt to produce protective measures and capital controls, neither of which are helpful to economic well-being.

- The International currency system is broken and cannot continue much longer. The dollar will likely lose its world reserve currency status when that occurs. China, Russia and other countries are looking forward to this event.

- The US economy began its downslide in the middle 1970s. Much of the so-called growth since then was debt-driven consumption and growth in government. Neither is real growth. Both inhibit wealth creation.

Other Factors

- Government is no longer a servant; it has become the master. Political decisions are made in the best interests of politicians, not citizens.

- Dependency has become a way of life for a large portion of the population. Since the so-called “Great Society” programs of the 1960s, many believe they have a “right” to be supported by others. Some families are three generations into this dependency state.

- Seniors who planned their lives based on promises related to Social Security and Medicare may be disappointed. Entitlement programs will be cut, it is only the structure of the cuts that is unknown.

Recent Economic History

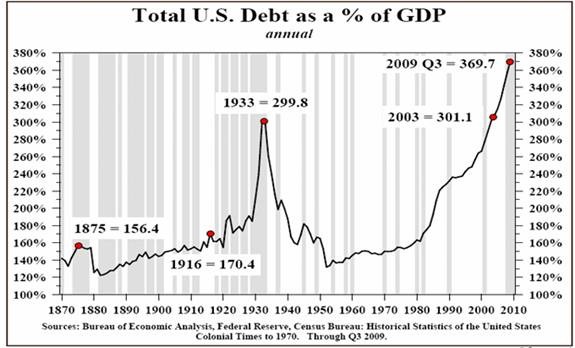

Much of the prosperity of the last twenty to thirty years was illusory. We lived beyond our means as a result of easy credit. Now we have the hangover from these good times in the form of excessive debt. The following chart is the single most important piece of information for understanding what has happened and what must happen. This chart conveys the magnitude of the debt as related to GDP.

This chart only includes the funded debt which is interest-bearing obligations like Treasury Bonds, car loans, credit card debt, etc. It does not include the unfunded liabilities associated with Social Security, Medicare, Medicaid and Pensions. These obligations, depending on whose estimate is used, are about three times the funded debt. Funded debt is in the area of $50 Trillion. Unfunded debt is another $150 Trillion. Several points can be made regarding this chart:

- The normal range of debt to GDP since 1870 appears to be between 130 to 170% of GDP.

- Debt only exceeded the upper bound of this range on two occasions, the period leading up to the Great Depression and the period preceding our current economic mess.

- The first occasion was nowhere near as severe as the current episode.

- Even while fighting WW II, debt was being liquidated or defaulted on. By the mid-1940s debt levels had returned to the normal range.

- The debt build up in the 1920s occurred over about 13 years. It took another 13 years to return to normal.

- The current buildup began 25 years ago. Will debt be contracting for the next 25 years?

- The chart is not quite current. The debt ratio is now up to 380%

An economy can only support so much debt. If that level is 150%, then we have in excess of 200% of GDP outstanding in excess debt. That represents about $30 Trillion of excess debt. To the extent that this amount of debt must be liquidated in some fashion, GDP will be $30 Trillion less over the next 10 to 25 years than it otherwise would have been. The ramifications of the debt are enormous:

- First, we are not in a traditional economic cycle. We suffer from a debt hangover. Government stimulus and liquidity injections are dubious when used to solve normal economic fluctuations. They are useless when dealing with a debt-induced downturn. The only way out of this mess is to deleverage. Providing more debt is the equivalent of providing a drunk in the process of sobering up with more booze. It might appear to make him feel better, but the next hangover will be that much more painful.

- Second, our living standard of the past 25 years was fictitious. Much of it was “bought” by mortgaging our future. Consequently, our future standard of living will be lower than it would have been. Savings will necessarily need to increase to pay down excessive debt. That will reduce consumption. While this is not a bad thing, it requires a less lavish lifestyle than most indulged themselves with for the last couple of decades.

- Third, the level of debt is impossible to service, especially for the federal government. For the impossibility of the government’s condition, see Spiraling to Bankruptcy.

In the next installment of this series, these political and economic facts of life will be used to shape an economic forecast.

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: