Budget Deficit Accounting Fraud and the Off-Balance-Sheet Student Loan Scam; Time to Scrap Entire Student Loan Program

Inquiring minds have been wondering why the federal debt has been rising far faster than cumulative federal deficits. The short answer is off-balance-sheet scams like student loans and Fannie Mae and Freddie Mac “assets”.

By Mike ‘Mish’ Shedlock at Mish’s Global Economic Trend Analysis

Inquiring minds have been wondering why the federal debt has been rising far faster than cumulative federal deficits. The short answer is off-balance-sheet scams like student loans and Fannie Mae and Freddie Mac “assets”.

A complete explanation comes from WC Varones in his post Mystery solved: the difference between the deficit and the increase in national debt

The ex-Wall Street types at ZeroHedge chewed on this but couldn’t come up with a good explanation. Karl Denninger called it crooked accounting, but couldn’t pinpoint the fraud. B-Daddy at the Liberator Today noticed the same thing and didn’t have an answer. Then I threw the question over to the academics at Econbrowser:

If it’s such a simple accounting identity, would you please reconcile the $1.9 trillion and $1.65 trillion debt increases in FY 09 and FY 10 with the alleged deficits of $1.4 trillion and $1.3 trillion for the same fiscal years?

And before you answer that it’s the Social Security Trust Fund, intragovernmental holdings increased by just $320 billion over the two years.

So where’s the other $530 billion?

None of the academics among the bloggers and commenters at Econbrowser could answer the question, until Menzie Chinn found an expert who could.

I and many others suspected the answer was in some off-budget shenanigans like Fannie/Freddie, GMAC, etc. It turns out we were right in general but missed the biggest specific off-budget item: student loans. In table S-14 of this FY2011 OMB Mid-Session Review shown to me by Menzie, you’ll see that the financial asset “Direct loan accounts” increased from $489 billion to $689 billion. And the prior Mid-Session Review (table S-15) shows that account at $196 billion at the end of FY08. So an increase in student loans accounted for $393 billion of the missing money over the two years.

There’s also an increase of $100 billion in “Government-sponsored enterprise preferred stock” (Because Fannie and Freddie are assets to the Treasury, not liabilities, right! How are those preferred dividends working out for you, Timmy?). Together with the student loans and the change in intra-governmental holdings, that explains the vast majority of the difference between the reported two-year deficit and the actual increase in debt.

Student Loan Scam

Thanks WC, I had been wondering that myself.

Let’s dig into Table S-14 (page 55 – PDF page 65) and look at projections for “Guaranteed Loan Accounts” under the general heading of “Debt Held by the Public Net of Financial Assets”.

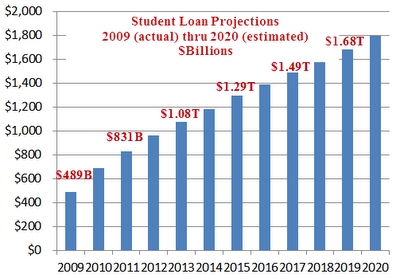

Using Data from the Table S-14 I made this chart of student loan projections.

Student Loan Projections 2009-2020 in $Billions

Time to Scrap Entire Student Loan Program

That debt is government (taxpayer) guaranteed. It is one of the primary things fueling the ever-rising cost of higher education. Amazingly students scream for more aid, and Obama want to give it to them, even though the debt destroys millions of lives in the process.

I propose the entire student loan program be scrapped. Much of that alleged “aid” goes straight to corrupt institutions like the University of Phoenix which charges exorbitant amounts for fluff degrees leaving students trapped as debt slaves for the rest of their lives.

For more on the University of Phoenix and other collegiate scams, please consider …

- Subprime Goes to College; Students Buried in Debt; Who is to Blame?

- Debt for Diploma Schemes and the Cookie Monster Principle

- University of California Campus Erupts In Riots; Student Loan Scam Drives Up Cost Of Education; Expect More Riots

Since student debt cannot be discharged in bankruptcy, and since universities get paid by the government, the universities (even legitimate ones) do not care how many lives they destroy.

The way to end the madness is to phase out all student loans over the next 3 years, immediately halting all new loans to freshmen. If colleges want to lend directly to students, nothing stops them. However, those debts should not be guaranteed by taxpayers.

The second thing we need to do is accredit far more online colleges. There is no reason legitimate courses cannot be offered over the internet at amazingly low prices.

These actions would quickly pop the bubble in higher education costs and make college affordable for nearly everyone without putting taxpayers at risk.

In the meantime, all off-balance-sheet debt needs to be properly accounted for in budget deficit projections, not hidden in places like Table S-14 where it took an army of people to figure out what was happening.

Mike “Mish” Shedlock

http://globaleconomicanalysis.blogspot.com

Mike Shedlock / Mish is a registered investment advisor representative for Sitka Pacific Capital Management.

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: