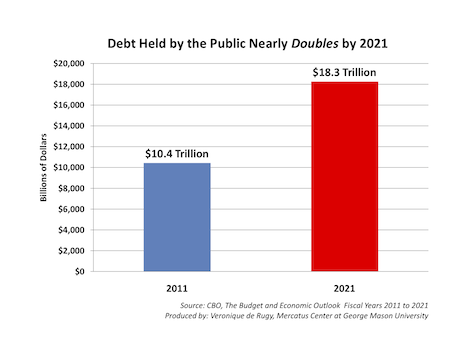

Debt Held by the Public Nearly Doubles by 2021

If current policies continue, debt held by the public will nearly double in the next ten years.

Veronique de Rugy at MERCATUS CENTER George Mason University

If current policies continue, debt held by the public will nearly double in the next ten years. According to the Congressional Budget Office, this measure of debt, which does not include securities issued by the Treasury to federal trust funds and other government accounts, will reach $18.3 trillion by 2021. The reality of this debt, and of the compounding interest payments that it will require, remind us that action must be taken to restore fiscal order sooner rather than later.

The above chart illustrates a simple statistic from the Congressional Budget Office’s most recent baseline projections: if current policies continue, debt held by the public will nearly double in the next ten years. According to CBO’s baseline projections, which estimate fiscal consequences according to current law, debt held by the public will reach $18.3 trillion by 2021; under a more realistic scenario, this debt would be even greater.

Under CBO’s baseline, the Bush tax cuts are allowed to expire, the alternative minimum tax remains un-indexed to inflation, real discretionary spending remains constant, and physician repayments under Medicare are drastically lowered. Even CBO finds this scenario highly unlikely.

That’s why CBO considers a more realistic scenario, where politicians cave in to political pressures and the reimbursement of physicians under Medicare gradually increases, spending is not bound by PAYGO, and taxes do not consume 21% of the economy.

Under this scenario, debt held by the public will reach $19.4 trillion, or 97% of GDP by the year 2021.

The immediate direct cost of this debt is that net interest costs will more than triple between 2011 and 2021, increasing from $225 billion in 2011 to $792 billion in 2021. For context, last year the federal government spent $700 billion dollars on the entire Social Security program. The reality of this debt, and of the compounding interest payments that it will require, remind us that action must be taken to restore fiscal order sooner rather than later.

Veronique de Rugy debunks the myths surrounding the debt ceiling on a Reality Check on Bloomberg Television.

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: