The Cause and Evidence of Inflation

The Fed and Treasury have set out on a deliberate strategy of creating inflation in order to monetize most of the $14.1 trillion national debt— a debt that is growing by well over a trillion dollars per year!

Michael Pento at Capitalism Magazine

In an inflationary environment, general prices tend to rise, although particular market segments tend to do so at uneven rates. This is hardly controversial. The more disputed question is why prices rise in the first place. As Luskin is well aware, the US Dollar is backed by nothing but confidence and perception. Its value depends upon our collective belief in its current and future purchasing power, and the hope that its supply will be restricted. When its supply is increased, users of the currency lose faith in its buying power and prices rise.

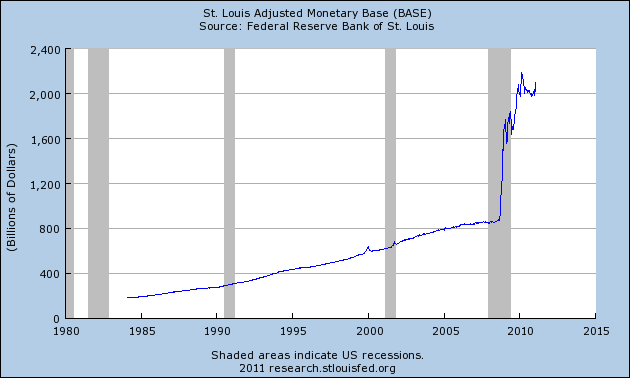

The charts tell the tale. There can be little doubt that the dollar is being debased. The graph below traces the growth of the monetary base, which consists of physical currency and Fed bank credit:

No doubt here. The supply of high-powered money has exploded.

Since the recession began in December, 2007, the M2 money supply has increased by over 18%.

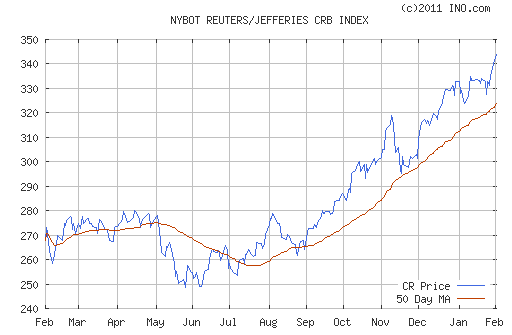

Next is the chart of the CRB Index, a group of 19 commodities used to track the overall price of raw materials:

The index clearly shows a strong trend upward, suggesting a general loss of value by the USD.

FULL ARTICLE

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: