More price hikes coming in consumer goods

Proctor & Gamble CEO says prices are going up in June on laundry detergents, hand and auto dish washing products, Iams pet nutrition, Head & Shoulders, Metamucil, paper towels, toilet paper, diapers and wipes.

By Michael Whipple, Editor usACTIONnews.com

Having already raised prices in February and March on Gillette shaving cartridges, disposable razors, and Duracell batteries, Proctor & Gamble CFO blames higher commodity and energy prices for costs.

“We’re also facing rapid and significant increases in commodity costs. Since the beginning of the fiscal year, the year-on-year impact from higher costs has more than tripled. We now estimate that materials and energy costs will be up roughly $1.8 billion before tax for the year.”

Earlier Wal-Mart CEO Bill Simon said that rising inflation in the United States is “going to be serious” and that Wal-Mart is “seeing cost increases starting to come through at a pretty rapid rate.”

Where have all these rapid cost increases come from? Largely two reasons and they both are political decisions.

ENERGY:

Energy prices are being driven up by the Obama administration. In the 2008 election campaign Obama said “under my plan electricity rates would necessarily have to skyrocket.” He kept his promise.

Failing to get higher energy costs or a carbon tax on energy passed through congress, Obama is using his federal agencies to regulate and sue energy producers. His Energy Secretary Steven Chu said “Somehow we have to figure out how to boost the price of gasoline to the levels in Europe,” in an interview with The Wall Street Journal in September 2008.

The Obama administration has pulled permits, delayed permits and even issued an illegal oil drilling moratorium. Obama has asked Middle East oil producing countries to produce more to reduce the cost of gas but won’t let production increase in the US. He seems to be doing everything he can to pus up energy prices.

Here are a few more ways Obama is forcing up gas prices from The Heritage Foundation:

- Immediately after taking office in 2009, Interior Secretary Ken Salazar, canceled 77 leases for oil and gas drilling in Utah.

- The EPA announced new rules mandating the use of 36 billion gallons worth of renewable fuels (like ethanol) by 2020.

- This summer President Obama needlessly instituted, not one, but two outright drilling bans in the Gulf of Mexico.

- After rescinding his outright offshore drilling ban, President Obama has refused to issue any new drilling permits in the Gulf, a policy that the Energy Information Administration estimates will cut domestic offshore oil production by 13% this year

- Interior Secretary Salazar announced that the eastern Gulf of Mexico, the Atlantic coast, and the Pacific coast will not be developed, effectively banning drilling in those areas for the next seven years;

- The Environmental Protection Agency has announced new global warming regulations for oil refineries;

- Interior Secretary Salazar announced new rules making it more difficult to develop energy resources on federal land.

All of these policies raise gas prices at the pump.

A report put out by by the minority on the US Senate Committee on Environment and Public Works entitled EPA’S ANTI-INDUSTRIAL POLICY: “THREATENING JOBS AND AMERICA’S MANUFACTURING BASE” stated that:

“The evidence is clear: these rules threaten the economic viability of America’s manufacturing base and hundreds of thousands of well-paying jobs. Moreover, these rules will bring little, if any, public health or environmental benefits. As Americans suffer through a jobless recovery, EPA is pursuing policies that exacerbate our economic problems and do not improve the environment.”

Energy prices are reflected in the ricing costs of almost all goods and services. What does anyone produce or do that does not require energy?

WEAK DOLLAR:

The second major factor mentioned by P & G’s CFO is increases in commodities. Commodities are the raw materials for making consumer products. Corn, wheat, sugar, oil (which includes many plastics and chemicals), and steel are examples.

The cost in dollars of these materials goes up when the value of the dollar goes down. How does the value of the dollar go down? Printing more money.

You will hear the chairman of the federal reserve, Ben Bernanke, say the Fed is not printing money. That is technically true since they create money digitally now with simple computer entries but the effect is the same as back when the money had to be printed.

Michael Pento at Capitalism Magazine spells it out:

[T]he US Dollar is backed by nothing but confidence and perception. Its value depends upon our collective belief in its current and future purchasing power, and the hope that its supply will be restricted. When its supply is increased, users of the currency lose faith in its buying power and prices rise.

Since the recession began in December, 2007, the M2 money supply has increased by over 18%.

Investor’s Business Daily lists these items as contributing to rising prices:

• The $2 trillion in money created by the Fed under “quantitative easing” since 2008, an unprecedented shot of liquidity pumped straight into the economy.

• The $5.5 trillion in new debt added by our government in just three years — nearly a 60% rise.

• The record 29% jump in federal spending in President Obama’s first three years, which has crowded out private spending and business investment.

• Spending on TARP and “stimulus,” which could total nearly $2 trillion when all is said and done.

The list goes on.

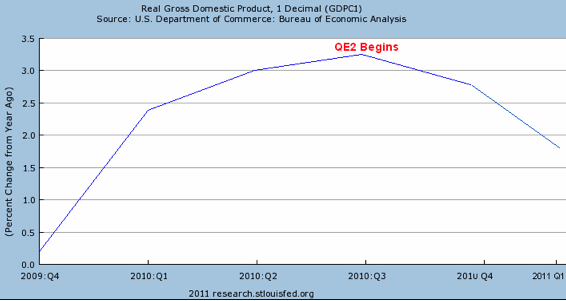

Quantitative easing is a term the Fed coined to make printing money to buy US debt sound like more than nonsense. Its also known by its acronym QE. We are currently enduring QE2 and many expect there may be a QE3 or more.

The federal reserve continues to print money out of thin air to buy the debt created by out of control government spending. Alan Greespan said “Deficit spending is simply a scheme for the confiscation of wealth.”

Here is a chart that shows how the GDP has fared with “quantitative easing”;

These higher prices at companies like P & G and Wal-Mart are a sneaky hidden tax you pay for government polices that are driving up the costs of energy and driving down the value of your income and savings.

Follow Michael Whipple on Twitter

Follow usACTIONnews on Twitter or on Facebook

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: