You lie! Solyndra Solar Failed By Poor Cost Structure, Not China or Bush

Obama lies again blaming his failed half a billion dollar Solyndra bust on China and Bush even though the DOE loan was DENIED by the Bush administration but revived by Obama and China had nothing to do with Solyndra’s failure.

IBD reported that:

… the results of the congressional probe to date shared with ABC News show that on Jan. 9, 2009, two weeks before President George W. Bush left office, the Energy Department’s credit committee voted against a loan commitment for Solyndra. [emphasis added]

The White House pressured federal officials to OK a loan to an insolvent but politically tied green energy company ….

The White House has denied applying pressure or even monitoring the review process, saying the stimulus loan guarantee was a good “investment.”

The emails show these statements to be false and that the White House knew Solyndra, whose major investor was Tulsa billionaire and Obama fundraiser George Kaiser, was at risk of going under.

…………

In an SEC filing in March 2010, independent auditor Pricewaterhouse Coopers said several negative financial factors regarding Solyndra “raise substantial doubts about its ability to continue as a going concern.”

The emails show the White House was ignoring the obvious warning signs.

Clearly the Obama administration pushed hard to approve the loan even though it had been refused just weeks earlier by the Bush administration. They knew it was a bad loan but a big Obama fundraiser was involved and some good PR for his environMENTAList supporters.

Blaming China doesn’t work either.

Previously reported on usACTIONnews.com by EconMatters from the article “Solyndra Solar Failed By Poor Cost Structure, Not China“:

The ongoing news coverage of Solyndra, the ill-fated solar panel manufacturer which filed for bankruptcy on Sept. 6, and the circumstances surrounding its loan from the U.S. government make it seem like a “Solyndra-gate” in the making for the White House.

Somehow, China got dragged into this pure U.S. domestic event as this blog post by the U.S. Dept. of Energy basically blamed China for Solyndra’s failure:

“Solar panel manufacturing is a growing international market, with increasingly intense competition from Chinese manufacturers who are supported in many cases by interest free government financing that is much more generous than what the U.S. provides.”

In not so many words, Solyndra also hinted that much in its official statement:

“Solyndra could not achieve full-scale operations rapidly enough to compete in the near term with the resources of larger foreign manufacturers.”

I guess both DOE and Solyndra have totally forgotten about the ‘resources’ and ‘interest free financing’ provided to Solyndra by the U.S. government.

“[Solyndra] has borrowed $527 million of the $535 million Energy Department loan guarantee……and that Solyndra plans to include the Energy Department loan guarantee in its bankruptcy filing.”

But the buck did not stop there. Washington Post noted that

In February [2011], the Obama administration helped Solyndra in refinancing its $535 million federal loan, allowing the government to release another $67 million to the company.

From ABC News,

“Solyndra received a rock-bottom interest rate of 1 to 2 percent.…..even as an outside agency, Fitch Rating, scored Solyndra as a B+ — “speculative” — investment.”

If Fitch considers Solyndra ’speculative’, how Solyndra could have passed the government’s loan approval criteria would be something interesting to see.

The DOE and Solyndra also conveniently neglected to mention Solyndra’s demise has everything to do with its unsustainable cost structure using an ‘innovative technology‘ to produce solar panels. (Hint: innovative = costly)

An article from ElectroIQ dated Nov. 8, 2010 already questioned if Solyndra can reconcile cost-per-watt and sale price:

“In an S-1 filing a year ago, the company [Solyndra] said its average sales price was over $3.20 a watt, about 65% more than leading crystalline-silicon PV manufacturers. Its cost of manufacturing was over $6 a watt. Solyndra aims at $3.5 per watt by the end of 2011.”

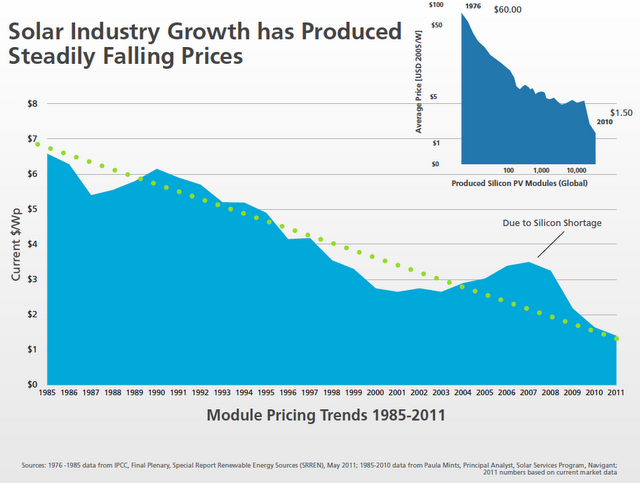

And what is the general industry price curve projection? Below $1 by Q1 2012! (See Chart Below)

With rapid growth, solar is probably one of the most competitive sectors with market players continuing finding new ways to manufacture, finance, package, sell and install solar driving down prices (See Chart Below).

This cost-reducing effort spreads across regions and is not just limited to Chinese companies. From RenewableEnergyWorld.com dated July 13, 2011

“First Solar has driven the cost of manufacturing cadmium-telluride thin films (which are about 15% of the market) to under 70 cents a watt; Amorphous silicon thin-film equipment manufacturer Oerlikon says its customers have cut module production costs to well under a dollar, and are on a path to get below 70 cents a watt in the coming months; and CIGS producer Solar Frontier, which just opened a 1 GW facility for the high-efficiency thin film, says that its technology is competitive with leading thin film manufacturers.”

The bankruptcy came barely a year after President Obama visited Solyndra as a model for government investment in green technology. The company was the first company to receive a loan guarantee under the 2009 stimulus law.

Initially, there was this back and forth argument about if the loan approval was under Bush or after Obama took office. Next thing you know, the FBI raided Solyndra’s headquarters in California, while the U.S. Treasury Dept. and the Energy Dept. also launched separate investigations of the government loan to Solyndra.

Last but not least, Solyndra’s biggest shareholder — Argonaut Ventures — is backed by Obama fundraiser George Kaiser. Argonaut, along with some other private investors, would stand to get every penny Solyndra has to offer even ahead of the U.S. government due to some loan restructure deal done right before the bankruptcy. And there were indications that White House might have rushed the loan approval to meet certain political PR deadline.

With American taxpayers potentially getting stiffed with about 600 million dollars worth of bad loans from Solyndra, it is easier to point the finger at China, the biggest market competitor of the U.S. (and every other country in the world) so not to take a deeper look at the problems closer at home.

Once a dominant manufacturing force in the world, over the past 70 years, the U.S. has gradually shifted its economic structure into one that’s technology, financial and services oriented, and outsourced most of the manufacturing needs to other countries including China. That has resulted in the U.S. losing its competitiveness in the goods producing sectors, including solar panels.

Nonetheless, quality, efficient innovation, and technology has enabled some Western companies such as First Solar and Solar Frontier to still compete with China. Solyndra’s downfall is due to the company’s outdated business model and its failure to get ahead of the curve in a fast changing market place.

Moreover, regardless when or where the Solyndra loan origination might have taken place, the fact is that the “loan execution phase” of this debacle occurred under the current Administration, which could have either revoked the loan or put Solydra under some kind of receivership on first signs of trouble (e.g., when solar panel prices started to drop like a rock) to safeguard taxpayers’ money.

Instead, the U.S. government simply made a bad ’speculative’ investment decision on behalf of the American public, based on questionable due diligence process and circumstances, but China has nothing to do with that.

Obama continues his lies and deceit about energy. Billions have been wasted on failed green schemes by Obama to buy votes from environMENTALists and funnel taxpayer dollars to campaign supporters.

His wind power jobs have cost $14 MILLION per job. In one case aid $50 MILLION to NOT produce any power. He touts an Arizona solar plant that did work even though it cost $50 MILLION for five permanent jobs and supplies electricity to only 17,000 homes.

How long can we put up with this green insanity?

Follow Michael Whipple on Twitter

Follow usACTIONnews on Twitter or on Facebook

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: