Government Borrows Thirty Cents of Every Dollar to Sustain Spending Levels

These deficits will eventually have to be paid for by future taxpayers. To steer clear of deficits, we must cut spending and reform entitlement programs.

By Veronique de Rugy at Mercatus Center

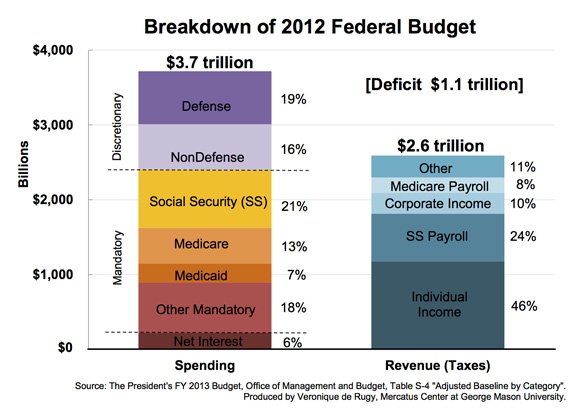

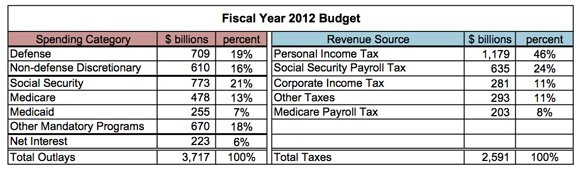

The federal deficit has surpassed $1 trillion for the fourth consecutive year. This chart places the federal budget for fiscal year 2012 into perspective by comparing the most recent historical spending and revenue data presented in the President’s Fiscal Year 2013 Budget.

In 2012, the federal government spent $3.7 trillion, exceeding the amount of federal revenue by $1.1 trillion. The government borrowed 30 cents of every dollar spent in order to sustain this level of spending. These deficits will eventually have to be paid for by future taxpayers. To steer clear of deficits, we must cut spending and reform entitlement programs.

Here’s a breakdown of the data:

- Defense: 19 percent of the budget, or $709 billion, went to military activities of the Department of Defense, nuclear-weapons related activities of the Department of Energy, operations in Iraq and Afghanistan, and other national security activities administered by other federal agencies. (These programs are represented under budget function 050.)

- Entitlements: 41 percent of federal spending was spent on entitlement programs. 59 percent of federal spending occurs automatically through mandatory programs. Social Security, Medicare, and Medicaid are the primary drivers of spending.

- Social Security: 21 percent of the budget, or $773 billion, provided social insurance benefits for the retired and the disabled.

- Medicare: 13 percent of the budget, or $478 billion, was spent to provide health coverage for the retired and disabled.

- Medicaid: 7 percent of the budget, or $255 billion, was spent on income-based health services.

- Net interest: 6 percent of the budget, or $223 billion, was spent on interest payments on the national debt.

- The personal income tax provides nearly half of the entire tax revenue. Social Security payroll taxes account for a fourth of entire receipts. All other sources of tax receipts are below 10 percent.

Data note: Other mandatory spending includes unemployment benefits, food stamps, child nutrition and tax credits, student loans, supplemental security for the disabled, etc. Non-defense discretionary spending accounts for spending that goes through the appropriations process for other major agencies such as the Departments of Agriculture, Commerce, Education, Energy, Transportation, etc.

Veronique de Rugy is a senior research fellow at the Mercatus Center at George Mason University. Her primary research interests include the federal budget, homeland security, taxation, tax competition, and financial privacy issues.

Also please consider:

Debt Now $16 TRILLION and Climbing Fast

Debt quotes

Mark Levin: Obama is a Marxist

Debt Jumps More Than $1T for 5th Straight Fiscal Year

Fed’s holding of US debt up 452% under Obama

After the Sovereign Debt Crisis Comes the Deleveraging

Politicians as Economic Arsonists

Too Much Debt: Our Biggest Economic Problem

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: