Financial Regs INCREASED 17.9% BEFORE the Crash

Dodd-Frank will cause a 26 percent increase in financial regulatory restrictions.

By Patrick McLaughlin & Robert Greene at Mercatus Center at George Mason University

Three years ago the Dodd-Frank Wall Street Reform and Consumer Protection Act was signed into law. Deregulation of the financial services sector in the years leading up to the 2008 crisis was—and still is—used to justify Dodd-Frank’s substantial regulatory burdens. But financial regulation did not decrease in the decade leading up to the financial crisis—it increased.

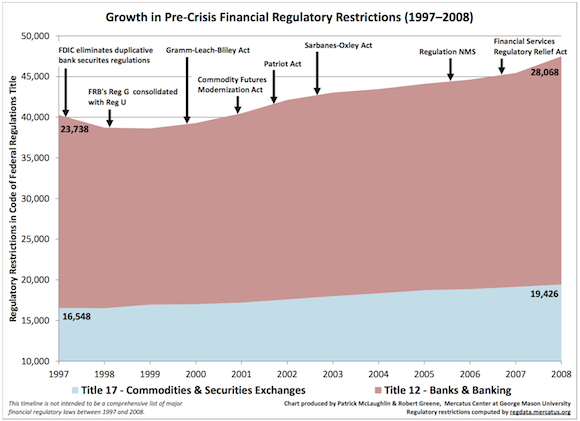

Using the Mercatus Center at George Mason University’s RegData, we find that between 1997 and 2008 the number of financial regulatory restrictions in the Code of Federal Regulations (CFR) rose from approximately 40,286 restrictions to 47,494—an increase of 17.9 percent. Regulatory restrictions in Title 12 of the CFR—which regulates banking—increased 18.2 percent while the number of restrictions in Title 17—which regulates commodity futures and securities markets—increased 17.4 percent.

RegData measures regulatory restrictions by counting the number of restrictive words and phrases—such as “may not,” “must,” “shall,” “prohibited,” and “required”—in each title of the CFR. Developed by Patrick A. McLaughlin and Omar Al-Ubaydli, RegData is computer-based and thus only able to calculate regulatory restrictions for 1997 and subsequent years because electronic copies of the complete, annual CFR are publicly available from the Government Printing Office for only that time period.

Total regulatory restrictions pertaining to the financial services sector grew every year between 1999 and 2008, increasing 23 percent during this time. The Patriot Act, the Sarbanes-Oxley Act, and Regulation NMS all contributed to this growth. The repeal of parts of the Glass-Steagall Act via the Gramm-Leach-Bliley Act did not result in noticeable deregulation of the financial services sector. Nor did the Commodity Futures Modernization Act facilitate overall financial deregulation. Not even the Financial Services Regulatory Relief Act of 2006, legislation intended to decrease regulatory burdens on the financial industry, reversed the ever-growing burden of regulatory restrictions faced by the financial services sector in the years leading up to the financial crisis.

Net decreases for Title 12 regulatory restrictions between 1997 and 1999 largely reflect an effort to streamline regulatory text. Only the FDIC portion (volume 4) of Title 12 experienced a significant decrease in pages between 1997 and 1998, and it was almost entirely isolated within 12 C.F.R. § 335, which was shortened from 136 to 7 pages in an effort to streamline FDIC regulations with pertinent SEC Securities Exchange Act regulations. Similarly, the comparatively small decrease in overall regulatory restrictions in Title 12 between 1998 and 1999 is in large part attributable to the Federal Reserve’s 1999 consolidation of Regulation G—which pertained to nonbanks’ extension of leverage for the purpose of purchasing certain securities—with Regulation U, which was revised to be applicable to both banks’ and nonbanks’ extension of leverage. Without this consolidation, Title 12 pages would have increased between 1998 and 1999. Neither of these episodes had any relation whatsoever to Gramm-Leach-Bliley or the Commodity Futures Modernization Act.

As we show in this analysis, financial regulatory restrictions increased 17.9 percent in the years leading up to the crisis. Without the streamlining efforts of the late 1990s—which reduced duplicative regulatory text and were unrelated to the acts of Congress typically blamed for alleged deregulation—this figure would likely be even higher. In Dodd-Frank: What it Does and Why it’s Flawed, we used the RegData methodology to estimate that Dodd-Frank will cause a 26 percent increase in financial regulatory restrictions. Policymakers should reexamine the presumption that Dodd-Frank’s substantial regulatory restrictions are necessary to offset previous deregulation of the financial services sector. On net, RegData shows that no such deregulation occurred. In fact, the financial sector was increasingly regulated over the decade leading up to the financial crisis.

Also please consider:

Dodd-Frank’s Protection Racket

The Dodd-Frank Financial Fiasco

The Dodd-Frank Wall Street Reform & Consumer Protection Act of 2010: Is It Constitutional?

Gut FinReg Too

Invasion of the privacy snatchers -Dodd-Frank

Ten Reasons to Oppose Dodd-Frank – a message for Scott Brown

Only Dodd-Frank bill that should be passed is one to jail them both

The Dodd-Frank Financial Fiasco

Covering Their Fannie

House passes egregious finance’reform’ bill despite warnings

The End of Community Banking

Job killing finance ‘reform’ bill nears deal

Finance Bill’s Devilish Details

How Obama and Democrat policies caused the financial crisis- video

How Economics and Politics, not Capitalism, Failed the Country

Housing market ruined by leftist good intentions

The “Economic Problem” is Not Economic

15 million homeowners ‘under water’ – flood of pending foreclosures?

Barney Frank Is Anything But On Housing

The Cynically Ruthless Barney Frank, Enabler Of The Mortgage Meltdown

Barney’s new excuse

Barney Frank Must Go – probably to jail

“Ten Most Wanted Corrupt Politicians” for 2009

New Obama appointee had role in housing crisis

Building the next subprime crisis

“Ten Most Wanted Corrupt Politicians” for 2009

Fannie-Freddie Fix at $160 Billion With $1 Trillion Worst Case

Covering Their Fannie

The Bottomless Pit Of Fannie And Freddie

CRAven Cover-Up

Why Radicals Matter

Has the SEC Charged the Right People with Securities Fraud?

Hoyer: No Plans Yet by Democrats To End Fannie, Freddie Bailouts

Democrats rejected a Republican plan to end the government’s support of mortgage giants Fannie Mae and Freddie Mac

Why are Fannie and Freddie left out of finance reform?

Republican Opens Investigation Into Hedge Fund and Advocacy Group Groups Deny They Worked to Inflate Housing Bubble

Paulson gets tax deductions for giving million$ to ‘non-profit’ that lobbies for his billion$ in profits

The Center for LESS Responsible Lending

Repeal CRA, stop blackmailing banks and wrecking the economy

Barney Frank Must Go – probably to jail

2008 Market Crash Should be Investigated

Greenspan Gets It (Why Not Others?)

Greenspan agrees leftist housing laws caused crash

And now they are in charge of everything! We are sure to go broke.

Burning Down The House: What Caused Our Economic Crisis? Bombshell

The Housing Boom and Bust by Thomas Sowell» A must read to all of us who are interested in the housing boom and bust, which led to the current financial crisis.

The history of the housing crisis and why we MUST throw the bums out!

Why is Obama Administration Hiding $5 Trillion More Debt with Accounting Gimmicks That Would Make Enron ‘Blush,’?

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: