“Green” Energy Receives 82X More in Tax Preferences – Time to Drill, Baby Drill

“Since taking office, Obama has invested billions of taxpayer dollars in private businesses [mostly in renewable energy companies], including as part of his stimulus spending bill. Many of those investments have turned out to be unmitigated disasters — leaving in their wake bankruptcies, layoffs, criminal investigations and taxpayers on the hook for billions.”

By Mark J. Perry at Carpe diem

| 2011 | Tax Preferences | Production (quadrillion BTUs) | Preferences per Quadrillion BTUs |

|---|---|---|---|

| Renewables | $12.9B | 7.52 | $1,715,425,532 |

| Fossil Fuels | $1.7B | 81.08 | $20,966,946 |

| Renewable/Fossil Fuels | Fossil Fuels/Renewables | Renewables/Fossil Fuels | |

| Ratio | 7.6 | 10.8 | 81.8 |

Update: See related analysis from my AEI colleague Steve Hayward last September on the Enterprise Blog (federal electric subsidies per unit of production).

Drill, Drill, Drill = Shovel-Ready Jobs, Jobs, Jobs

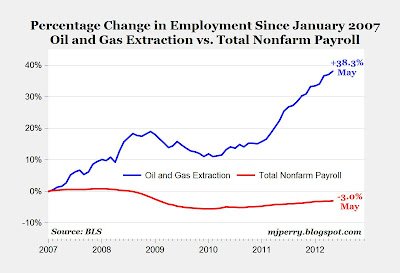

While [Friday’s] disappointing employment report reflects an economy struggling to create jobs during an extended, sub-par “jobless recovery,” it’s been a much rosier employment picture in one of America’s most successful “shovel-ready” job-creating industries: Oil and Gas Extraction.

The chart above displays the monthly percentage changes in employment levels since January 2007 for oil and gas extraction jobs compared to total nonfarm payroll jobs. As of last month, total nonfarm payroll employment is 3.0%, and 4.1 million jobs, below the January 2007 level. In contrast, the explosion of new oil and gas jobs has increased employment in that industry by more than 38% since January 2007. Over the last 12 months, oil and gas companies have added 21,800 new workers, at a rate of almost 100 new hires every business day. And this just accounts for the new jobs created that involve the actual drilling, extraction and production of oil and gas.

A recent study found that for every one new job added in oil and gas extraction activities, there were three new additional jobs created elsewhere in the economy. The report also found that “the jobs-multiplier effect of U.S. oil and natural gas activity is higher than many other U.S. industries, including the financial, telecommunications, software and non-residential construction sectors. This is the result of the energy industry’s long supply chains and relatively high levels of spending by employees and suppliers.” As a result of the multiplier effect, the U.S. economy has potentially been adding almost 400 new jobs per day over the last year due to increased oil and gas production.

Imagine what the jobless rate might be today, and imagine all of the additional shovel-ready, energy-related jobs (direct and indirect jobs) that could have been created over the last several years in the oil and gas industry (and its supporting industries), if the Obama administration: a) hadn’t been so unfriendly to the low-cost, job-creating, dependable fossil fuel industry (think Keystone XL pipeline for example) that doesn’t require picking the pockets of the taxpayers; and b) instead been so over-friendly to the subsidy-dependent, high-cost, unreliable but politically-favored “green” energies. On the other hand, imagine what the jobless rate might be today if we hadn’t had the tremendous “energy-stimulus” to the U.S. economy that has resulted over the last few years from increased oil and gas drilling due to technological advances of hydraulic fracturing and horizontal drilling, and taking place mostly on private land?

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: