SSA Losing Billions Every Year With Renewal of Bonds –

The loss of income from the redemptions comes to a cool $3.3Bn a year. That is chump change at SSA – but it will happen again next June when another chunk of high coupon paper rolls off the books. – Bruce Krasting

By Bruce Krasting

EXCERPTS:

Social Security is sitting on a $2.8Tn portfolio of T Bills and Notes.

——-

$600 Billion! 22% of the nut went back in forth in a single day.

———–

SS’s holdings of all that paper is part of part of the “debt we owe ourselves”. Actually it is just debt that is owed, it’s no different than the IOUs out to China. There are a total of 230 Trust Funds (SS is the largest), the total of this debt is now $4.8Tn.

———-

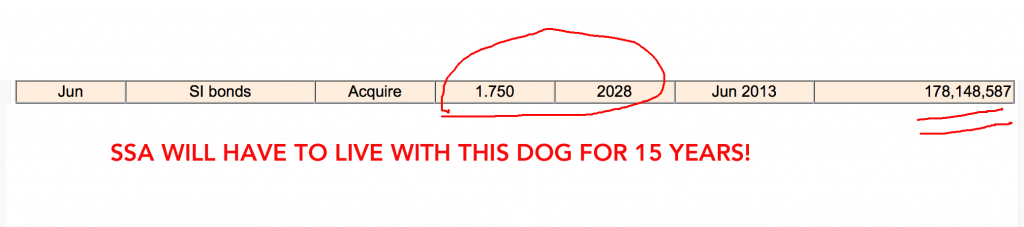

SSA “bought” $178 BILLION of bonds due in 2028 at measly 1.75%. This return is going to be less than inflation. The market yield for 15-year Treasury paper is 3%. SSA is underwater on this bond by 1.25%, that comes to a revenue loss of $2.3Bn every year. Blame this result on a 50-year old formula and Bernanke’s endless squeeze on interest rates.

The pollution of interest income for savers like SS is well understood by Bernanke and his cohorts at the Fed. But they never talk about this ‘cost’ to the country’s future. They just harp on all of the benefits that low interest rates deliver, like renewed housing bubbles in places like Vegas and ever higher stock prices. I estimate that the cost to just SS of the Fed’s actions will add up to over $300Bn before the Fed folds its cards and ends QE and ZIRP.

FULL ARTICLE

One of Bruce Krasting’s readers responded thus:

“Actually, Don, the Social Security Trust Fund doesn’t work that way at all. ALL payroll taxes are converted into special treasury notes as the taxes are paid, 100% of them. There are no payroll taxes held by the Trust Fund that are used to pay benefits. Benefits are paid 100% by liquidations of the special treasuries. The transactions above clearly show this. So, Congress ‘borrows’ (steals) our payroll taxes, then forces future generations of taxpayers to pay the theft back, at interest. But the money is gone….spent.

By the way, they are called ‘special treasuries’ because they can be liquidated at any time without penalty.

Furthermore, the treasuries held by the Trust Fund are NOT assets to the US taxpayer, they are, in fact, debt instruments upon which the taxpayer is paying interest. As such, they comprise a component of the national debt. A quick gander at the GAO’s Components of National Debt chart shows the Trust Fund as a component of the debt.

Thus, there is NO MONEY in the Trust Fund, only debt…debt that must be paid back, at interest. In point of fact, our benefits are paid-for at least twice: once when we pay our payroll taxes (stolen and spent by Congress), and the second time by the future generation of taxpayers that has to actually pay to repay the treasury from which the benefits are paid. If one calculates the interest paid over a working lifetime, it could very well be three times over. Keep in mind, this is interest the taxpayer is paying on his/her own money…

The system has functioned this way since it started collecting taxes in 1936. No one started ‘raiding’ the fund after the fact, It was designed this way from the beginning. Why? Because the Social Security system is a mechanism for taxation whose basic mechanics operate more like those of a Ponzi Scheme, than a retirement program. How many retirement programs take the investors’ money and convert it into a debt instrument upon which the investor pays interest? None, that I’ve ever heard of…but that is precisely how the Trust Fund works.

There is nothing hidden or mysterious about this, either. The lies are in plain sight on the Social Security website:

(Social Security Administration-Trust Fund FAQ)

http://www.ssa.gov/OACT/ProgData/fundFAQ.htmlJimmy Jack Jingo”

Also please consider:

Is This Country Different? Will the Big Bang Be a Shock?

1% Growth: Fed Policy a Failure, Time for A Change

Millions of Long Term Jobless May not Be Counted in Faux “Recovery”

Smoke And Mirrors Running Out — Depression to Follow

SEVERE (economic) Storm Warning

A Message from Lord Vader

Has Obama Already Bankrupted America?

Is The Fed Acting Like a Day Trader?

17 Reasons the $17 Trillion Debt Is Still a Big Deal

Government Zombie Policies and the Rationing of Retirement

Obama Has Stolen $5.3 Trillion From Our Children In Order To Make Himself Look Good

Obama on debt in 2008

Debt quotes

Obama’s Achievement – Gov’t Has Become Gigantic Wealth-Transfer Machine

Obama sued banks to give subprime loans to Chicago’s African-Americans

A billion here a trillion there, soon you’re talking about real money

People who will vote for Obama still believe what he says

Obama Has Stolen $5.3 Trillion From Our Children In Order To Make Himself Look Good

Debt Now $16 TRILLION and Climbing Fast

Debt quotes

Mark Levin: Obama is a Marxist

Debt Jumps More Than $1T for 5th Straight Fiscal Year

Fed’s holding of US debt up 452% under Obama

After the Sovereign Debt Crisis Comes the Deleveraging

Politicians as Economic Arsonists

Too Much Debt: Our Biggest Economic Problem

California and Illinois are living in Obama’s second term

Twenty-Nine Reasons to Be Angry And/Or Scared – Still

The Real End Game, We’re Coming To The End

Obama leads “Forward” to ruin and destruction

Not Worth a Continental

So you think we’re better off?

New report – Billion$ in Obama’s auto bailout went to rich unions

Spending and debt causing global slowdown

Fed’s holding of US debt up 452% under Obama

Beck Explains Why the Federal Reserve Is a Complete ‘Scam’

Obama’s real spending record

By Incentivizing Debt, We’ve Guaranteed Debt-Serfdom and Stagnation

CBO: spending binge endangers our children’s future

Dangers of Government Dependency – Econ 101

Sen. Dirksen Left Vs Right in 1964

CBO Agrees: Less debt, lower tax rates good for economy, jobs & growth

Leftists call for more of the same – spending and debt

Potential Victories for Individual Rights in 2012

Please Excuse My (Failed) President

Obama campaign panicking over bad economic news – “not a single idea” – Krauthammer

On Shills, Technocrats, Politicians and the Sinking Ship

Economy tanking under Obama

You lie! Krauthammer: Obama spending claim “unbelievable distortion of the truth”

Why Obama Failed

U.S. Set to Lead World Over Debt Cliff Into Recession

Rubio: “Do people back home fully understand”

Government has doubled since 2001 – Sen. Coburn

Obama railed against deficits until he became radical record breaking big spender

The other Obama on PAYGO

Obama’s $5 Trillion Moment

Paul Ryan: President’s failed policies causing record poverty

Gov. Mitch Daniels: Debt ‘Will Lead to National Ruin’

U.S. Student Debt To Reach $1.4 Trillion by 2020

34 Shocking Facts About U.S. Debt That Should Set America On Fire With Anger

King of debt

Return to Debt Mountain

15 Trillion Dollars In Debt, 45 Million Americans On Food Stamps And Zero Solutions On The Horizon

Obama warns Americans not to panic while he ruins the economy

What Do You Believe — Cash or Government Propaganda?

National debt really $24 TRILLION

THE FALLACY OF A RETURN TO NORMALCY

42% See U.S. Debt Default Somewhat Likely in Next 5 Years

New Obama Record – Debt Growth to Top Economic Growth for Decade

Help Make A Difference By Sharing These Articles On Facebook, Twitter And Elsewhere: